Oh, the joys of watching Bitcoin (BTC) take a little dip from its recent highs, only to have the crypto community still believe it’s on a mission to hit the $120K mark. 🚀 It’s like watching a stubborn donkey refuse to stop, even when it’s had a few too many carrots. 🥕

Bitcoin Technical Analysis: A Nap Before the Next Big Leap?

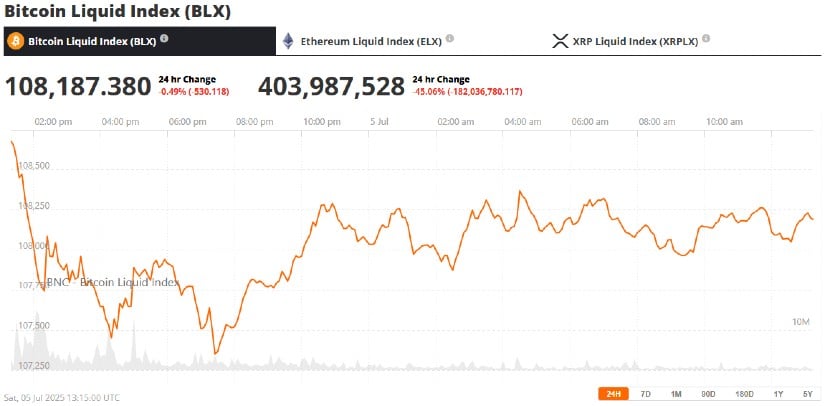

Bitcoin (BTC) has been testing the $107,000–$108,000 support zone after getting a bit of a slap in the face near $110,500. 🤚 The market showed signs of fatigue after a 10% rally from local lows near $98,000. But, oh boy, Bitcoin’s chart still looks like it’s got a spring in its step, with higher lows and a MACD crossover on the daily timeframe that’s practically shouting, “More upside, please!” 📈

On the 1-hour and 4-hour charts, BTC is taking a little nap under the $109,000 resistance. A clean break above this level—especially if it’s backed by a good dose of volume—could be the ticket to retesting the all-time high of $112,000. On the downside, strong support lies around $106,000–$107,000. If these levels hold, the bulls might just wake up and stage another breakout attempt over the weekend. 🐂

Whale Moves, Dormant Wallets, and ETF Inflows Shape Sentiment

Bitcoin’s recent dip to $107K came despite a whopping $1 billion in net inflows into spot BTC ETFs over just two days. Surprisingly, the downturn seems to be more about a historic on-chain event: the movement of 80,000 BTC—worth over $8.6 billion—from a dormant wallet that’s probably older than your grandma’s favorite teapot. 🫖

Such a large transfer understandably spooked some traders. But on-chain analysts are quick to point out that these moves are often more symbolic than immediately bearish. After all, moving such a large amount of Bitcoin in public is generally seen as a way to avoid an immediate sale, as it would draw too much attention and risk impacting the market price. Instead, the transfer triggered a bit of FUD (fear, uncertainty, and doubt)—a classic move in Bitcoin’s playbook. 📜

ETF inflows, particularly into products like BlackRock’s iShares Ethereum Trust ETF (ETHA) and Grayscale’s ETHE, show that institutions are still very much interested. Even though Ethereum has been hogging some of the spotlight this week, Bitcoin remains the star of the show for institutional flows and long-term positioning. 🌟

Bullish Signals Persist Despite Pullback

Multiple technical and macro indicators are lining up in Bitcoin’s favor. The recent confirmation of a bullish MACD crossover, combined with BTC’s highest monthly close ever, adds a bit of confidence that the pullback might just be a healthy correction. 🏥

Even with some profit-taking and macro headwinds—like U.S. trade tensions and fiscal policy concerns—Bitcoin remains as resilient as a rubber duck in a bathtub. Funding rates on BTC futures remain positive, suggesting that long positions still dominate and the broader market maintains a bullish stance. 🦆

Despite the short-term uncertainty, market sentiment remains firmly bullish. While the path to $120,000 may not be a straight line, Bitcoin’s strong technical setup, rising ETF inflows, and resilient investor demand suggest a breakout could be on the horizon—pending confirmation above key resistance levels. 🌈

BTC Outlook: Is $120,000 in Reach?

From a structural perspective, Bitcoin is entering a critical phase. The $112K level remains the immediate resistance to beat. If BTC can break and close above this psychological and technical ceiling, price discovery could quickly accelerate. 🚀

On the flip side, if BTC fails to hold the $106K support, it might trigger a retest of the $103K–$104K range. However, with liquidation heatmaps showing dense liquidity clusters near $110K, and positive ETF flows continuing, the bias remains to the upside. 📈

Final Thoughts

Despite the ongoing spell of short-term volatility, Bitcoin’s larger trend points upward. ETF demand, favorable technical setups, and macro tailwinds are all aligning in BTC’s favor—even as dormant whales stir the pot. The next few sessions will be pivotal as BTC tests resistance near $109,000 and aims to reclaim $112,000. Should bullish momentum hold, Bitcoin’s next big stop could very well be $120K. 🌟

As always, volatility remains a defining feature of crypto markets. But if current trends persist, Bitcoin may soon rewrite its all-time high—once again proving that the bulls are far from done. 🐂🚀

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-07-06 12:41