As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen more market fluctuations than I care to remember. The recent downtrend in EigenLayer (EIGEN) has caught my attention, not just because it’s been falling for four consecutive days, but because the “7 Siblings” have decided to buy the dip. These are heavyweights in the crypto world, known for their strategic moves and deep pockets.

For four straight days, the value of EigenLayer’s token decreased, but “The Seven Sisters” took advantage of this dip by purchasing tokens, anticipating an upcoming price increase.

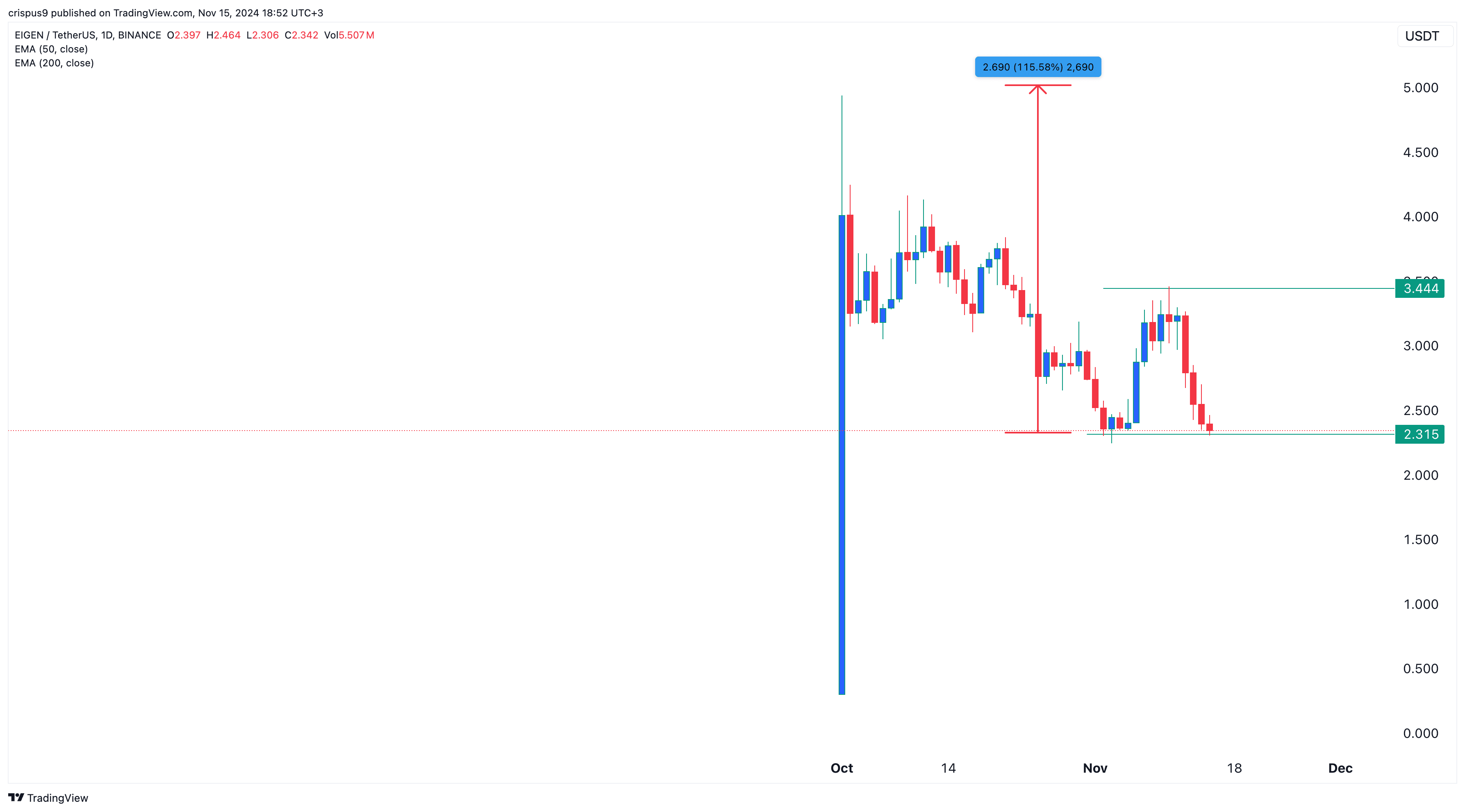

EIGEN’s token value dropped to $2.3, marking a new low not seen since November 3rd. This is a decrease of 33% from its peak this week and a drop of 52% from its record high.

According to data from Nansen, “seven individuals” purchased approximately 1.07 million EIGEN tokens worth around $2.59 million. This could indicate that they anticipate the value of these tokens to rebound in the future.

Over the last two days, the group “The 7 Siblings” earned approximately 1.06 million dollars’ worth of $EIGEN by exchanging 833.75 Ether, which is currently valued at around 2.59 million dollars, with an average price per Ether of about 2.43 dollars.

— Onchain Lens (@OnchainLens) November 15, 2024

This purchase stands out as they are among the largest cryptocurrency investors, boasting over $106 million in their digital wallets. The majority of their investments consist of staked Ethereum (ETH) tokens, Compound (COMP), and USD Coin.

Despite Infura unveiling plans for a decentralized public infrastructure network on EigenLayer, the value of EIGEN tokens still declined. Notably, Infura is a significant player in the crypto industry, handling over 700 billion RPC requests annually. The upcoming launch follows RedStone’s deployment of its testnet on Eigen’s AVS network.

EigenLayer now stands as a prominent figure in the realm of Decentralized Finance, offering reinvestment solutions. With more than 12.89 billion dollars worth of assets under management, it ranks as the third largest DeFi network, trailing behind Lido and AAVE.

EigenLayer initiated an airdrop back in September and has amassed a market capitalization of approximately $435 million. However, its fully-diluted valuation has seen a significant decrease from over $6 billion to currently stand at $3.9 billion. One major hurdle is that around 14.9% of the total market value will become unlocked in December, potentially diluting the holdings of existing investors.

Will EIGEN price retest $5?

As a crypto investor, I’ve noticed that my EigenLayer investment has been following a sharp decline over the past few days, marking four consecutive drops. This downtrend seems to have kicked off when the EigenLayer token exhibited a ‘shooting star’ pattern on November 10th. This is a commonly recognized bearish reversal signal in technical analysis, suggesting potential price reversal could be imminent.

On Friday, EIGEN’s stock price stood at $2.315, marking a significant dip since this was its lowest point for the day on November 3. Additionally, it fell beneath its 15-day moving average.

On the upside, the formation of a double-bottom pattern suggests a potential bullish reversal. If this pattern plays out, it could lead to an increase in the price of the coin, potentially reaching the resistance level at $5 – a significant jump of 115% from the current price level.

If the price falls slightly below $2.31 (which is currently serving as a supportive level), it could signal a shift in the bullish outlook, allowing for a continued decline that might extend to approximately $1.5.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-11-15 19:12