As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I find myself intrigued by WOO‘s recent surge. With my fingers firmly on the pulse of the crypto world, I can’t help but notice the significant growth this token has experienced in the past 24 hours. The 17% jump in price and the whopping 691% increase in daily trading volume have certainly caught my attention.

Over the past day, the cost of WOO surged by a significant 17%, making it the top gainer among the 300 major digital currencies currently in circulation.

At the moment of writing, WOO was being traded at $0.2109, which represents a 59% increase from its lowest point in September, which was $0.1327. The market value of this asset has now exceeded $385 million, having risen from an initial value of $284.9 million at the start of September.

The WOO platform provides a mix of traditional and blockchain-based financial solutions, designed to boost liquidity within the cryptocurrency market. Among its offerings are WOO Exchange, a centralized trading platform, WOOFi, a decentralized exchange, and Wootrade, a specialized liquidity pool catering to institutional investors.

The surge in trading activity is primarily being fueled by South Korean traders, with the WOO/KRW pair on Bithumb accounting for approximately $36.8 million in trades within a 24-hour period, according to CoinGecko data. Binance follows closely behind, registering around $23.5 million in trading volume.

🥵 — WOO X (@_WOO_X) September 30, 2024

As a result, there was an extraordinary increase of about 691% in the daily trading volume, reaching around $119.5 million.

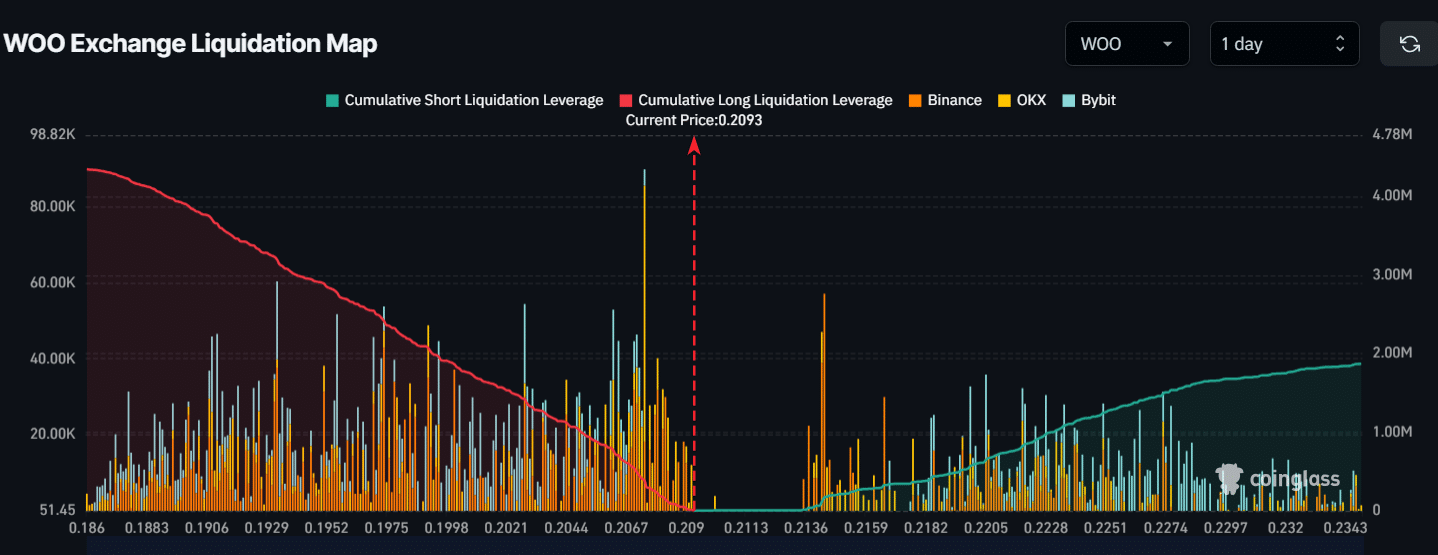

Possible short squeeze approaching?

According to CoinGlass data, the open interest for WOO surged by 81.4%, reaching $20.16 million, along with an increase in trading activity, suggesting that more investors are getting involved.

If WOO‘s trading value surpasses its 50-day Moving Average, it demonstrates robust bullish energy. On the other hand, an RSI (Relative Strength Index) exceeding 76 suggests the market is overbought, implying a possibility for further growth but also increasing the chance of a temporary dip or consolidation as traders might decide to cash out their gains. This could mean more advancement, yet it also hints at the potential for a brief pause or adjustment in price.

The current breakdown points for WOO are at $0.2074 and $0.2143, as per CoinGlass. It’s noticeable that intraday traders often use a lot of leverage. If the price drops to $0.2074, it could lead to approximately $358,000 in long position liquidations. Conversely, if the price rises to $0.2143, around $168,920 in short positions might be liquidated.

As I currently analyze the market data, it appears that bears have taken the lead, which could potentially result in the termination of long positions at relatively lower price points due to increased bearish influence.

Additionally, the funding rate for WOO has decreased from 0.0055% to -0.0433%, indicating a shift towards more bearish opinions. But if the price keeps rising, it might spark a short squeeze, forcing short sellers to buy back their positions and potentially causing prices to increase further.

In the buzz around WOO among Korean traders, a user of platform X raised concerns about WOO X’s principles of transparency, claiming that it was pushing exchanges to temporarily halt the selling of WOO tokens. The user deemed this action as dubious, implying that even though WOO markets itself as open, members of the community have detected such suspicious behavior.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-10-01 12:37