As an experienced cryptocurrency analyst, I’ve witnessed numerous market trends and price fluctuations throughout my career. With that said, Worldcoin (WLD) has caught my attention as it currently ranks among the top gainers in the crypto market.

Among the leading 100 cryptocurrencies, Worldcoin (WLD) stands out as the top performer during this bullish market trend.

As a researcher studying the cryptocurrency market, I’ve observed a significant increase in the value of WLD over the past 24 hours. Specifically, there’s been a surge of 23.6%. At this moment, the price of WLD sits at $6.50 – a level not seen for the past three weeks. Additionally, its market capitalization has grown to approximately $1.32 billion, placing it as the 70th largest digital currency in terms of market size.

Moreover, the daily trading volume of Worldcoin recorded a 109% rally, reaching $520 million.

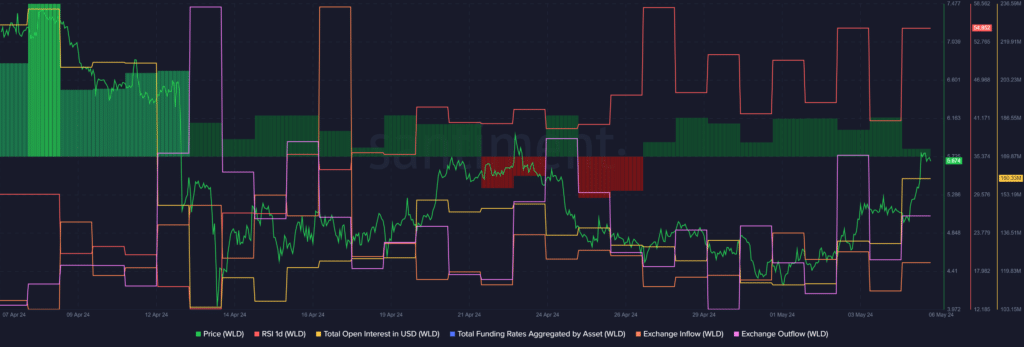

Based on the information given by Santiment, I found that the total open interest for WLD experienced a significant growth of approximately 21.5% within the last day. This increase brought the figure up from $131.9 million to $160.3 million at the time of reporting.

Due to the increased trading activity and sharp rise in open positions for Worldcoin, larger price fluctuations are likely as a result of whale transactions and possible margin calls.

The data obtained from the market intelligence platform indicates a decrease in the total WLD funding rate, which combined funds from all exchanges, from 0.008% to 0.001% within the last 24 hours. This decline suggests that the majority of the new open interests have been driven by an increase in short positions.

As an analyst, I’ve observed an intriguing development in the trading scene. The bets placed against a potential decline in WLD‘s price have significantly multiplied as its price has surged upward.

Based on Santiment’s analysis, there have been 454,380 Worldcoins (WLD) flowing into exchanges during the past 24 hours, while a greater volume of 542,360 WLD has been moving out of exchanges. This results in a net loss of approximately 87,980 coins for Worldcoin holders. However, these on-chain figures suggest that certain investors remain active in purchasing Worldcoins despite the prevailing pessimistic sentiment towards the asset.

As a crypto investor, I’ve observed that the WLD‘s Relative Strength Index (RSI) has seen a significant rise from 40 to 54 within the past 24 hours, according to Santiment. This indicator suggests that the asset is becoming slightly overbought, and a reading below 50 might indicate a more stable price increase ahead.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-06 12:04