As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market corrections and recoveries. The recent correction in the global cryptocurrency market cap to $3.42 trillion is no exception, but it’s always fascinating to see how the market bounces back.

On Sunday, the total value of all cryptocurrencies combined (the global crypto market cap) was around $3.42 trillion, marking a nearly 10% decrease compared to two weeks earlier.

Last week’s market decline was significantly influenced by Bitcoin (BTC), which previously aimed for a price of $100,000 two weeks back. However, it dipped and tested the $90,000 support level before bouncing back to approximately $97,200 as of Sunday’s check.

In contrast to the bearish market trend last week, various altcoins showed remarkable progress. Here’s a look at some standout performers worth watching over the coming week:

XRP retests 2021 peak

Last week’s market recovery greatly favored XRP (XRP). Although it experienced a decline of over 12% from November 24 to 26, by the end of the week, XRP managed to achieve a significant increase of approximately 33%.

Specifically, following another test of $1.28 on November 26th, this altcoin experienced a significant surge the very next day, unexpectedly breaking through the $1.63 resistance that had previously hindered its growth. This allowed it to overtake Binance Coin (BNB), thereby claiming fifth position among the leading assets.

Initially, XRP continued its upward trend and reached $1.81. Subsequently, it surged even more to $1.9586, a level last seen during the peak of April 2021. This latest price point represents a retest of the historic $1.96 resistance from that period. Notably, veteran trader Peter Brandt had predicted that XRP could potentially rise if the $1.96 barrier were to be surpassed.

Ready to RIP $XRPUSD

Massive coil

2023 high now cleared

If 2021 high is cleared, then 🎑🚀🚀🚀🚀🚀— Peter Brandt (@PeterLBrandt) November 18, 2024

Should XRP maintain its upward trajectory this week and surpass the $1.96 mark, it will at last regain the $2 level for the first occasion since the 2018 market surge.

Its next Fibonacci level from here sits at $2.35 (Fib. 1.272), with further resistance at $2.56 (Fib. 1.414).

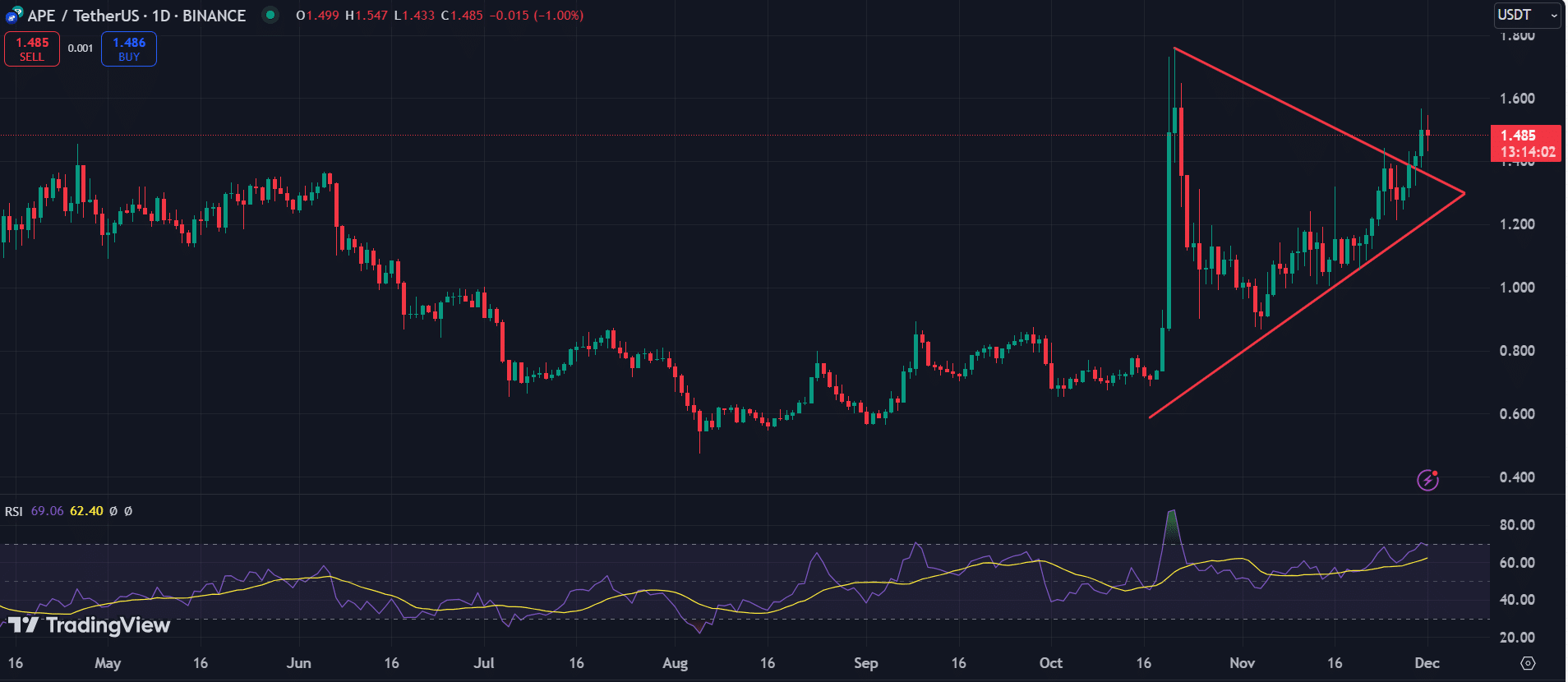

APE breaches 5-week triangle

ApeCoin (APE), the Bored Ape Yacht Club (BAYC) ecosystem token, saw a 13.6% increase last week.

Following the general market upswing, APE started its upward movement on November 27. Notably, by November 29, it had increased by 11%, breaking above the upper line of a five-week symmetrical triangle due to continued bullish energy.

Come the end of the week, APE attempted to re-check the downward slope by moving towards the trendline’s support point at $1.380. Yet, the buyers proved resilient, sparking a surge that carried the asset up to $1.5 by the week’s close.

The price of APE has fallen below $1.5 now, and its Relative Strength Index (RSI) remains close to overbought zones at 69. In the current week, the bulls need to guard the $1.3 area to maintain an upward trend above a symmetrical triangle. If the price dips back into this triangle, it may indicate a change in momentum towards bearish.

Yuga Labs, the team behind the BAYC and Mutant Ape Yacht Club (MAYC) NFT collections, created APE.

APE will reportedly unlock 15.6 million tokens on Dec. 17.

ALGO spikes 51%

Last week, Algorand’s native token, ALGO, experienced significant growth. In fact, it surged by an impressive 51%, making it one of the top performers among cryptocurrencies.

The majority of ALGO’s growth happened on November 29th, as the cryptocurrency experienced a substantial surge of 36.92%, marking its largest single-day increase for the year. Prior to this rally, Algorand had seen the development of a golden cross on November 25th, signifying that its 50-day moving average exceeded its 200-day moving average.

Following the positive market trend, the asset reached and surpassed the $0.48 level for the first time since the Terra crash in May 2022. Some analysts anticipate further growth, even predicting a potential surge up to $1.50.

Previously, ALGO experienced a bullish cross during the initial stage of the bull market in Q4 2023, which subsequently triggered a 96% surge. Currently, for ALGO to maintain its upward trend, it needs to surpass its next significant barrier at $0.4893. Conversely, falling below $0.40 could potentially dampen the current momentum.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-12-01 17:38