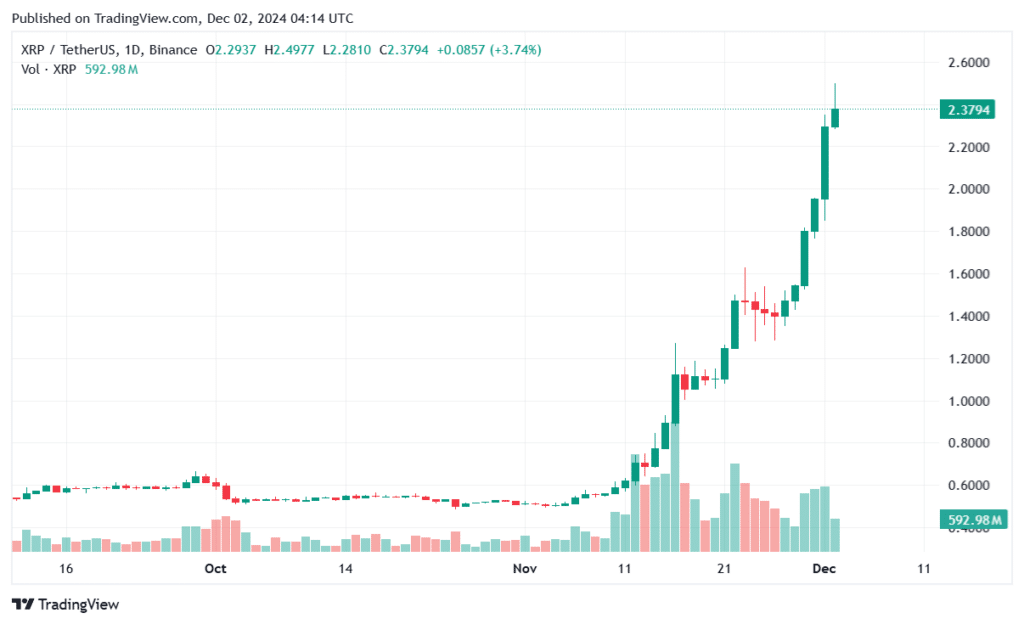

As a seasoned crypto investor with over a decade of experience under my belt, I must admit that the recent surge in XRP has caught my attention. The 365% increase from $0.51 to the current price of $2.3 in just a month is nothing short of impressive, and it’s not every day you see a cryptocurrency challenging the big boys like Bitcoin and Ethereum for the number two spot.

Over the past week, XRP, a digital currency developed by Ripple Labs Inc, has experienced substantial growth. This upward trend has propelled its market capitalization to rank third, making it the third largest cryptocurrency following Bitcoin and Ethereum.

On November 2nd, as per CoinMarketCap’s records, the price of XRP has soared by approximately 27.72%, rising from $1.8 to $2.3 at the time of reporting. Remarkably, over the past month, its value has skyrocketed by an impressive 365% from $0.51, earning it a spot among the top performers alongside Peanut (PNUT), Stellar (XLM), and Hedera (HBAR).

Due to a 26% increase in its price, XRP’s market value has now placed it as the third largest globally, outranking Tether (USDT) and Solana (SOL) with their respective market caps of $134 billion and $108 billion.

On the given day, the value of these tokens was aggressively bought and sold for approximately 26.41 billion dollars, representing a 75% boost compared to the previous day’s value. Interestingly, just last week, XRP surpassed Binance Coin (BNB) in market capitalization when it reached 97 billion dollars, while BNB was still at 95 billion dollars.

Due to Ripple’s growing business and positive market sentiment, its price soared and set a new record high not seen since seven years ago, reaching $3.8.

XRP’s move on financial market

On November 25th, WisdomTree, a U.S.-based Bitcoin ETF provider, submitted a proposal for an XRP ETF to the state of Delaware. While this proposal has not yet been officially presented to the Securities and Exchange Commission (SEC), the financial market is already showing excitement due to the filings made to the Division of Corporations within the state.

As a researcher, I submitted a proposal for our crypto-focused product, specifically the 21Shares Core XRP Trust, to the commission on November 1st. Interestingly, Bitwise had previously submitted an application for a similar product in early October.

Despite the ongoing disagreement between Ripple and the SEC yet unresolved, there remains an upbeat market sentiment toward the upcoming Trump administration, which is known for its pro-cryptocurrency regulations. Furthermore, it’s expected that a new SEC chairman will be selected following the resignation of current executive Gary Gensler prior to President Trump’s inauguration.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-02 07:52