In my analysis as an analyst, I’ve noticed a significant surge in XRP‘s value over the past week, with a notable increase of approximately 42%. This upward trend continued on Friday, where it saw a near 1% rise. Remarkably, XRP reached a new all-time high, leaving Ethereum (ETH) trailing behind in terms of 24-hour trade volume on Thursday. Given the upcoming inauguration of President-elect Donald Trump, there’s a possibility that this momentum could continue in the coming days for XRP.

Table of Contents

XRP could extend rally alongside Bitcoin

As a crypto investor, I’ve noticed an impressive surge in the value of my XRP holdings, with a gain of over 40% within the last week. Meanwhile, Bitcoin (BTC), the leading cryptocurrency, bounced back from its sudden dip below $90,000 and regained momentum above $104,000 on Friday. It’s exciting to see that even the native token of the XRP Ledger is experiencing this positive movement in tandem with the top dog of cryptos.

Trump’s impending inauguration, along with positive expectations for cryptocurrency regulations, supportive policies towards cryptocurrencies, and a fresh perspective from U.S. financial regulatory bodies, are significant factors driving attention.

XRP could gain further, entering price discovery next week.

XRP trades at $3.26 at the time of publication.

On-chain indicators support gains

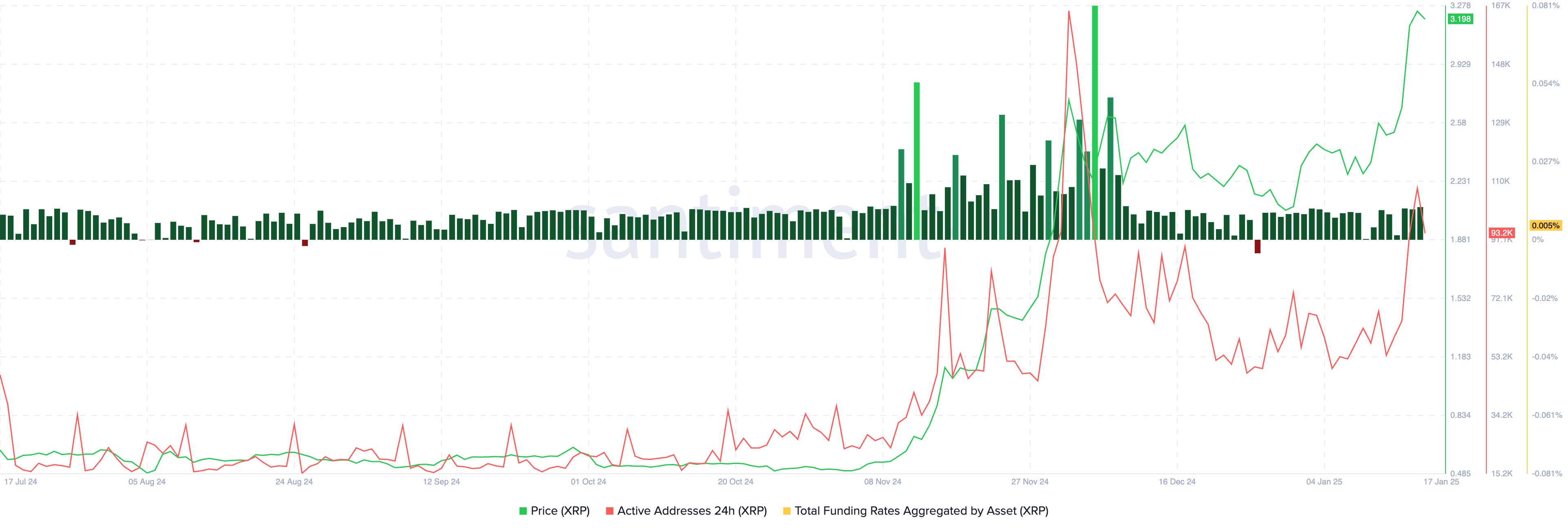

The signs on XRP’s blockchain suggest a positive outlook for the cryptocurrency. The overall funding rate remains above zero from January 2025. Moreover, there was a significant surge in the number of active addresses on Thursday, January 16th.

The on-chain indicators on Santiment are conducive to further gains in XRP in the coming week.

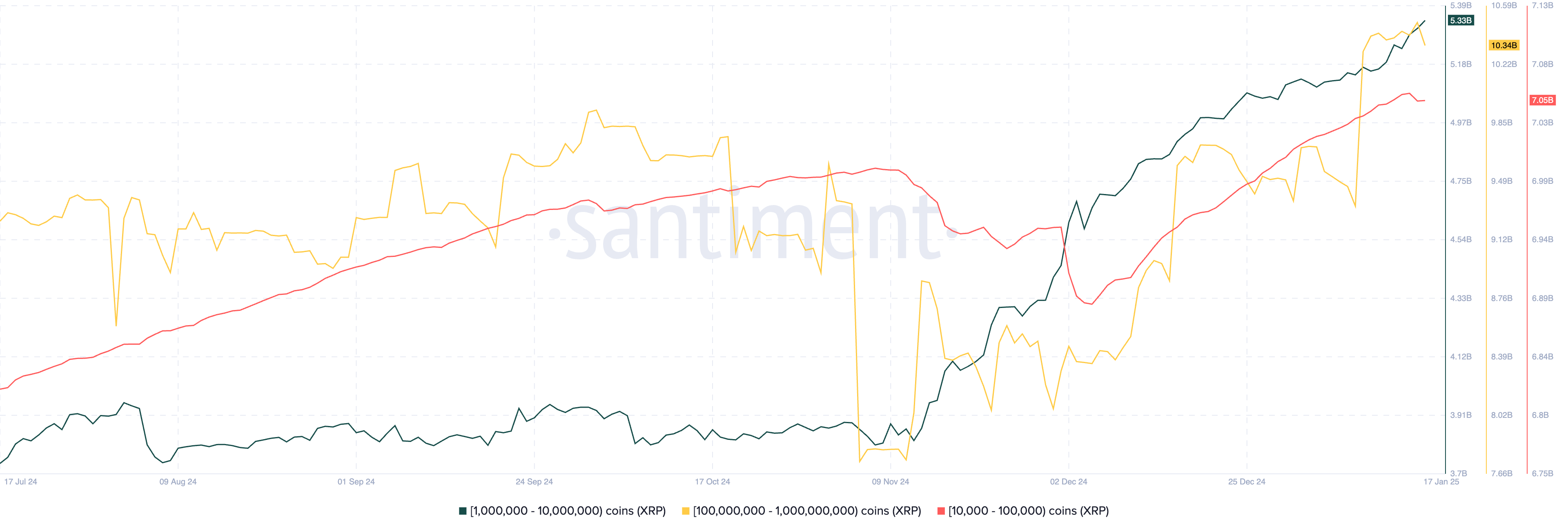

According to Santiment’s supply distribution metric, the amount of XRP tokens held by wallets with 10,000 to 100,000, 1 million to 10 million, and 100 million or more XRP has grown. These three categories of investors have been amassing XRP even as its price rises, which suggests a potential future increase in the price of XRP.

Market movers and Ripple lawsuit

On Mondays, cryptocurrency markets tend to experience significant shifts due to inaugurations. However, three primary factors are driving the price fluctuations of Ripple (XRP):

1. The increasing adoption of RippleNet by institutions.

2. Advancements in the development of the RLUSD stablecoin.

3. The ongoing lawsuit between Ripple and the Securities and Exchange Commission (SEC).

These factors play a crucial role in shaping the altcoin’s market trends.

Despite the U.S. Securities and Exchange Commission (SEC) filing an appeal against Ripple’s XRP on January 15, the altcoin persisted in its upward trend. The July 2023 decision by Judge Analisa Torres, which labeled secondary transactions of XRP as non-securities, is being contested. The SEC aims to reclassify these retail sales as unregistered securities sales.

Ryan Lee, chief analyst at Bitget Research, told crypto.news in an exclusive interview:

The increase in XRP’s value can be linked to the positive results in Ripple’s legal case with the SEC and a more welcoming attitude towards cryptocurrency within the US government. If regulatory issues are cleared up, an influx of institutional investors could potentially strengthen XRP’s standing within the crypto market even further.

It’s yet unclear if the Trump administration will advocate for crypto-friendly legislation and if their stance might impact legal disputes involving companies such as Ripple Labs, like in ongoing court cases.

Technical analysis and XRP price forecast

currently, XRP is near its maximum historic value of $3.40, and at present it’s being traded at around $3.2385. If it continues to rise by approximately 22%, XRP could reach new heights in terms of price, possibly hitting the 141.4% Fibonacci retracement level of its upward climb from the low of $1.9054 to the high of $3.4000.

The technical indicators, RSI and MACD, suggest a bullish outlook for XRP. Specifically, the MACD consistently shows green histogram bars, while the RSI indicates that the token might be overbought or overpriced at the moment, with a reading of 83. Therefore, traders should stay vigilant as they consider their investment strategies.

Should I need to correct an ongoing trend, I’d anticipate that the XRP price might encounter a potential support level around $2.6977, which represents approximately 50% Fibonacci retracement.

Expert commentary on XRP

James Toledano, COO at Unity Wallet, told crypto.news in an exclusive interview:

For nearly three years, XRP remained roughly at $0.50. However, its recent surge suggests increasing investor confidence due to anticipation of regulatory clarification and a possible approval of an XRP Exchange Traded Fund (ETF) within the coming months. If this ETF is approved, it could trigger a significant increase in investment, potentially pushing XRP to new highs by 2025.

Toledano advises XRP investors to stay cautious, as the unpredictability of alternative coins increases significantly within the present market trend.

He said:

The possibility exists that Alts ETFs could draw substantial investment, potentially boosted by supportive policies under the new U.S. government favoring innovation. However, it’s worth noting that their success might not be as steady compared to Bitcoin ETFs, given the fluctuating interest in altcoins, which often appear sporadic or episodic.

Let’s examine the ups and downs in Bitcoin’s price over the past week. The reasons behind these changes are complex; one might say they stem from Trump’s influence, seasonal trends, geopolitical events, economic indicators, and general sentiment, all combined. To consider another perspective, humans have a tendency to find patterns, but sometimes the underlying causes and effects aren’t directly connected due to hidden factors at play.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2025-01-19 03:38