As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market trends and cycles. With Ripple (XRP) nearing a crucial level ahead of the launch of its stablecoin, RLUSD, I find myself intrigued by the potential implications for this digital asset.

As the highly recognized digital currency focused on payments, Ripple, approaches an important threshold, just prior to the debut of its upcoming RLUSD stablecoin release.

On September 17th, Tuesday, Ripple (XRP) was priced at approximately $0.5850, and it has held this value for several months now, resulting in a market capitalization surpassing $32 billion.

As a researcher delving into the world of cryptocurrencies, I am eagerly anticipating the imminent launch of XRP‘s stablecoin, RLUSD, as I believe it could serve as a significant catalyst for the price movement of XRP. This new coin will be fully backed by the U.S. dollar at a 1:1 ratio, offering stability and potentially attracting more investors due to its close association with the USD.

Ripple anticipates that its stablecoin could become a major competitor within the sector, which currently boasts over $172 billion in assets. Tether (USDT), the world’s leading stablecoin, currently manages over $118 billion in assets and generates billions in revenue, surpassing the profitability of BlackRock, an organization with a staggering $10.7 trillion in assets.

Ripple’s biggest challenge will likely be the competitive nature of the stablecoin industry, where Tether has become highly dominant. Other popular stablecoins Ripple will compete with include (USDC), Dai, and PayPal’s PYUSD.

The price of XRP may be influenced by the upcoming Federal Reserve decision, potentially leading to increased interest in riskier assets. Notably, Ripple has tended to perform favorably when the Fed adopts a more accommodative stance. In 2021, it peaked at $2.00 following the Fed’s reduction of interest rates to zero due to the pandemic. Conversely, its value plummeted by approximately 60% in 2022 as the Fed raised rates.

XRP price nears a crucial level

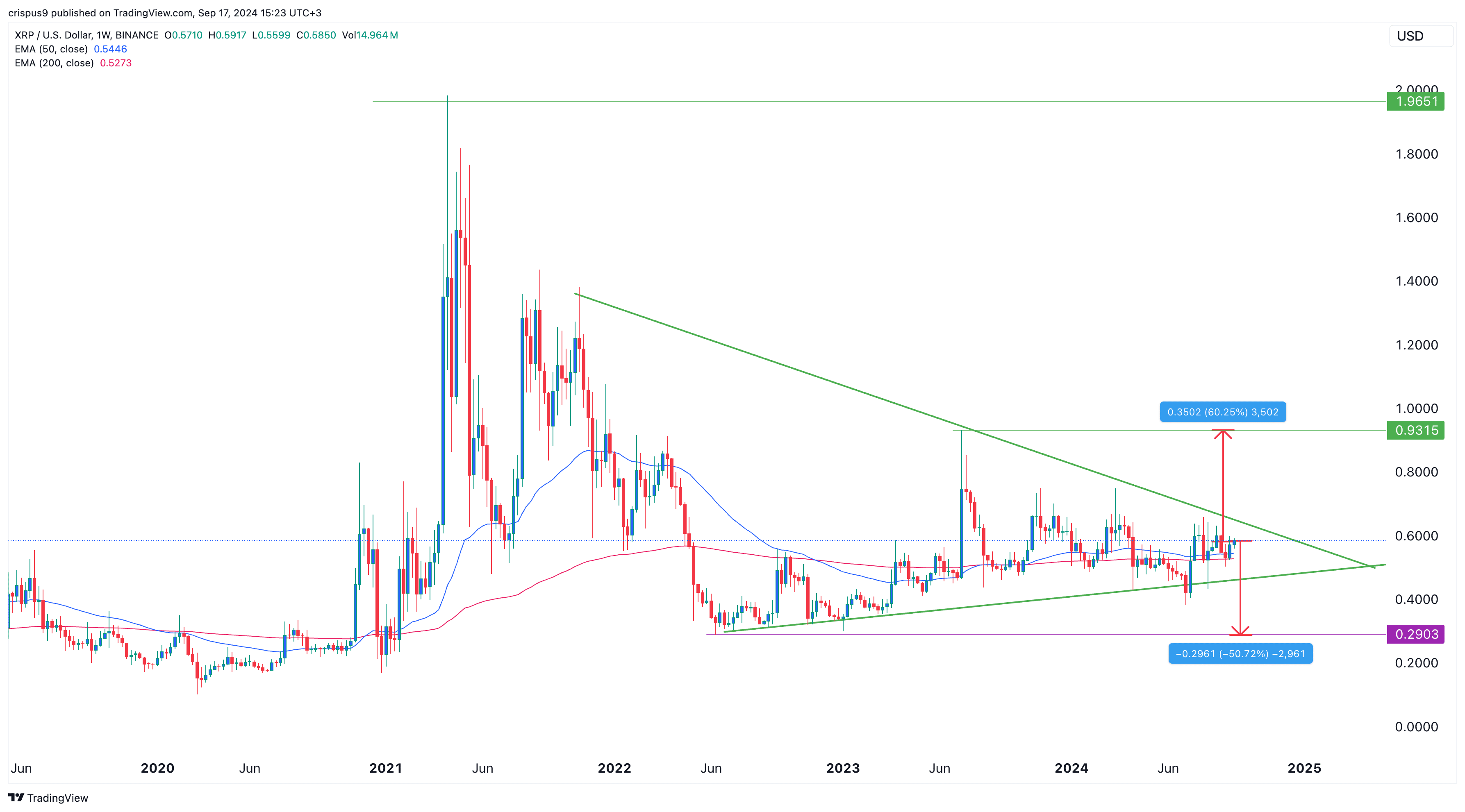

Over the last few months, I’ve noticed that Ripple has been moving within a narrow range, forming what appears to be a symmetrical triangle on the chart. This triangle is defined by the high point it reached in November 2021 and its lowest point since June 2022, suggesting potential consolidation or indecision in the market.

The edges of the triangle are getting closer to meeting at a merge point. Meanwhile, XRP has slightly risen above its 50-week and 200-week exponential moving averages, while the accumulation/distribution indicator is indicating a downward trend. Additionally, it has created a bullish flag on the monthly chart.

$XRP: “This near 7-year compression will be coming to an end soon. The mother of all bull flags.” –@CredibleCryptoAs I’ve said many times… $XRP cannot, and will not, stay in this range against the dollar forever.I firmly believe $XRP will ultimately hit a new all time high. — Moon Lambo (@MoonLamboio) September 17, 2024

As an analyst, I’m confidently predicting a notable shift for Ripple in the upcoming weeks. A volume-driven burst beyond the peak of the triangle could propel it towards the psychologically significant figure of $0.9315, representing its highest swing since July 2023 and marking a substantial 60% increase from its current value.

Instead, if the price weakens significantly and drops beyond the triangle’s lower boundary, it might continue downward to the next potential support at around $0.2900. This would mark a new low for June 2022, representing a 50% decrease from its current position.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-09-17 15:51