So, Sigil Fund – a firm that obviously knows a thing or two about making money – has bet the farm on stablecoins. And guess what? They’re all about Circle. Why? Because it’s the only thing that lets them get cozy with stablecoins in a way that actually makes sense. Who knew, right?

Stablecoins are apparently the hot new thing, according to Sigil Fund, which, let’s be honest, probably has some insider knowledge. The fund dropped a cool $5 billion into Circle’s pre-IPO pot, and by Tuesday, June 10, they were flashing a 4x return on that bet. Sounds like a real good day at the office. And if you’re wondering how good, I mean a 4x return in one year is not too shabby, even for the big leagues!

“Sigil Core threw some cash into Circle in July 2024. And guess what happened? On IPO day, the position added a slick +9% to the fund’s NAV. But here’s the kicker: total return has now hit around 4x. In a year. Talk about a financial home run.” – Sigil Fund.

The Circle IPO? Oh, it was a smash hit. Apparently, there’s still an appetite for crypto, even in a world that’s obsessed with traditional finance. Circle started trading on June 4 with a share price of $31. And by June 10, it had soared to $115.25. That’s a 271% increase in less than a week. Someone call the accountants – they need to update their calculators! 💸

Why Sigil Bet on Circle

Why did Sigil Fund choose Circle, you ask? Oh, just because they believe stablecoins are basically the “silent backbone of crypto.” They say stablecoins bridge traditional finance (tradFi, for those in the know) and decentralized finance. Even tech giants are getting in on the action, considering launching their own stablecoins. Guess what? The future is looking a lot more “stable” than you thought. 😏

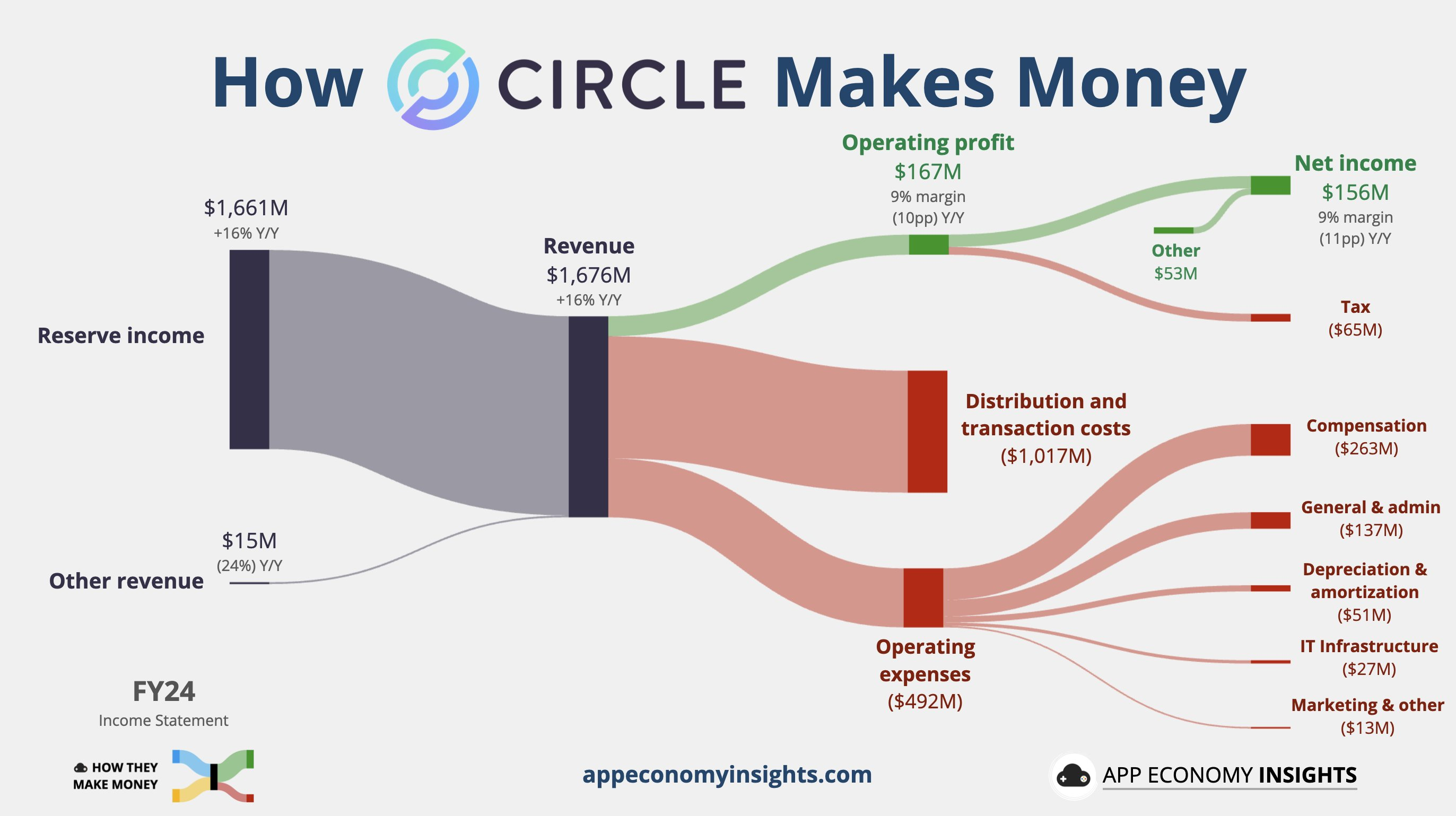

Circle is raking in revenue from the reserves backing its stablecoins. These reserves are mostly in short-term Treasuries and repo agreements, generating yield faster than a squirrel on espresso. And as Circle pumps out more stablecoins, the revenue just keeps rolling in. It’s like printing money, but legally. Well, kind of. 🏦💰

Currently, Circle is sitting pretty with $33 billion in reserves. That includes $11 billion in short-term Treasuries and $16 billion in repo agreements, which makes for a cool $1.46 billion in net revenue. And guess what? As the USDC market cap grows, Circle’s revenue and profits will too. It’s like a never-ending money-making machine. Can you say “cha-ching!”? 💵💵

And according to Sigil Fund, Circle is basically the only “clean investable” stock on the market for those looking to dabble in stablecoins. Why? Because Tether, the big dog of stablecoins, is private. And if you were hoping to snag some Tether shares, sorry, no dice. Looks like Circle is the only game in town, folks. 😜

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-06-10 16:09