Jurrien Timmer, Fidelity Investments’ global macro director—because who doesn’t want their financial advice delivered with a globe-trotting title—says the S&P 500 has taken a nosedive of about 20% this year. But don’t pop the champagne yet; according to him, it might be ready for a comeback. Cue the market’s dramatic music! 🎢

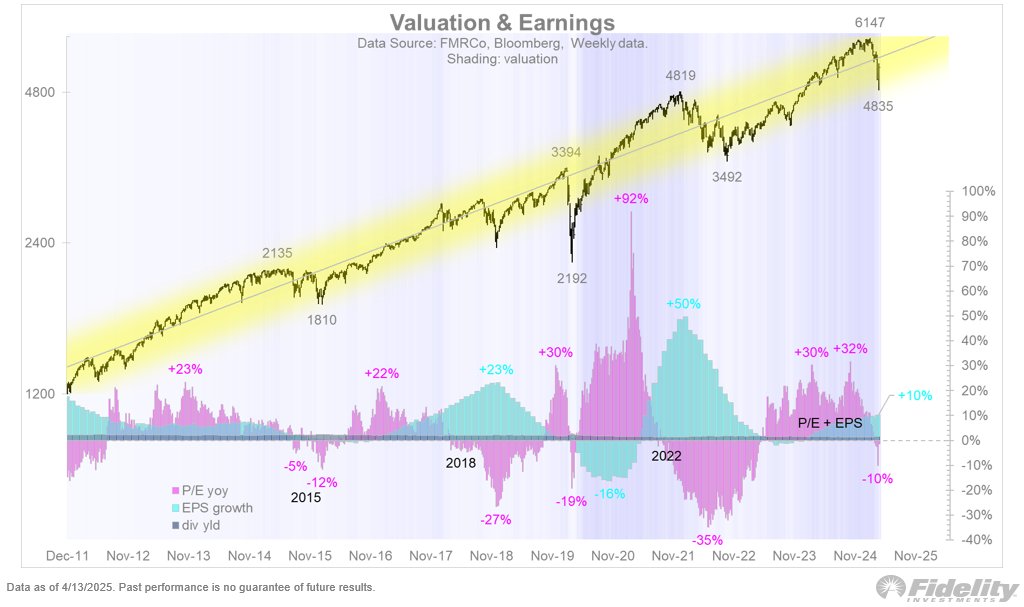

Over on X (yes, Twitter’s hip new name because change is the only constant), Timmer reminisces about the S&P 500’s flirty dance with a rising trendline since 2011. Apparently, this index swings back and forth like a pendulum—one moment it’s acting all high and mighty above the line, next it’s sulking way below. Classic market mood swings.

“If the S&P 500 can muster the courage to climb back over that breakdown point, it’ll be after swinging from extreme FOMO to extreme panic. Basically, the market’s saying, ‘I’ve felt enough pain, time to party again.’” 🥳

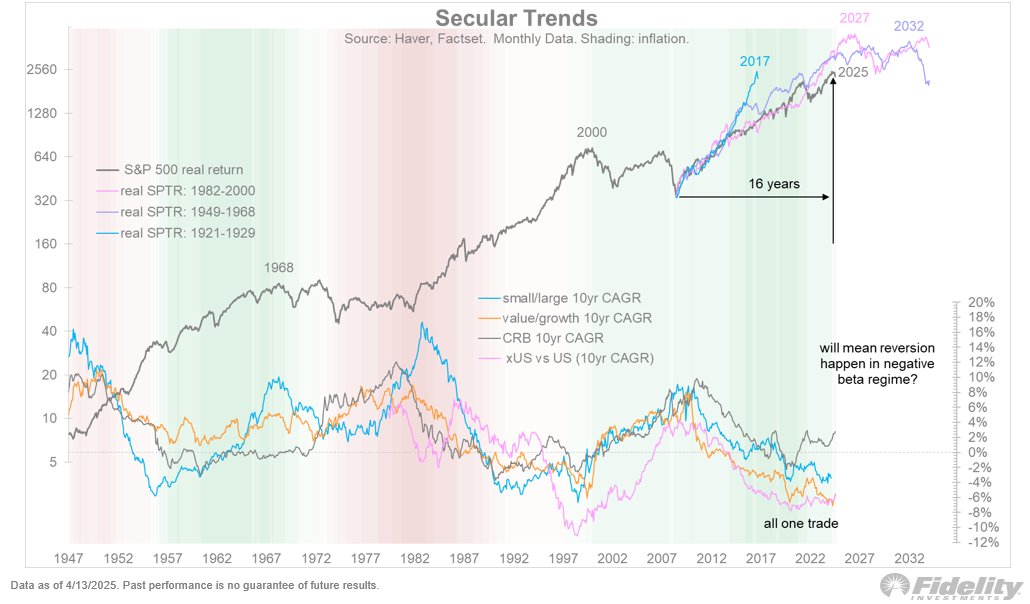

Despite Timmer’s optimism, he throws a serious plot twist: this long bulls-on-the-loose trend that kicked off in 2009 might be cruising toward its final season. Investors could be eyeing better bargains beyond America’s borders—because, hey, the world’s a big place, and ‘de-globalization’ sounds fancy enough to throw us all for a loop.

In his words (and yes, they do sound like the opening monologue of a dystopian economic thriller):

“We can’t ignore that the post-2009 bull market feels like that friend who overstays their welcome. With the de-dollarization and all this geopolitical chess, the market’s script might flip. Expect value stocks and international plays to crash the Mag 7’s decade-long dominance party.” 🧐

Last we checked, at Friday’s close, the S&P was flirting around 5,282 points. Will it keep dancing, or is it calling it quits? Stay tuned—because if the market were a TV show, this cliffhanger would have us binge-watching all night. 🍿📉📈

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

2025-04-21 17:44