In stunning news that’ll make your bubbe kvell and your accountant sweat, spot Bitcoin ETFs shot up for yet another day on Thursday, in a move so ambitious, even my Uncle Morty wouldn’t have bet on it! Why? Bitcoin—yes, that once-illegal internet coin your nephew wouldn’t shut up about—bounced back above $100,000 for the first time since February. Mazel tov! 🎉

Guess what? None—and I mean, not a single, solitary one—of the big-shot ETFs lost a dime yesterday. Apparently, Wall Street now believes in Bitcoin harder than my Aunt Esther believes in early-bird specials.

Bitcoin ETFs: More Inflows Than a Miami Hotel on Passover

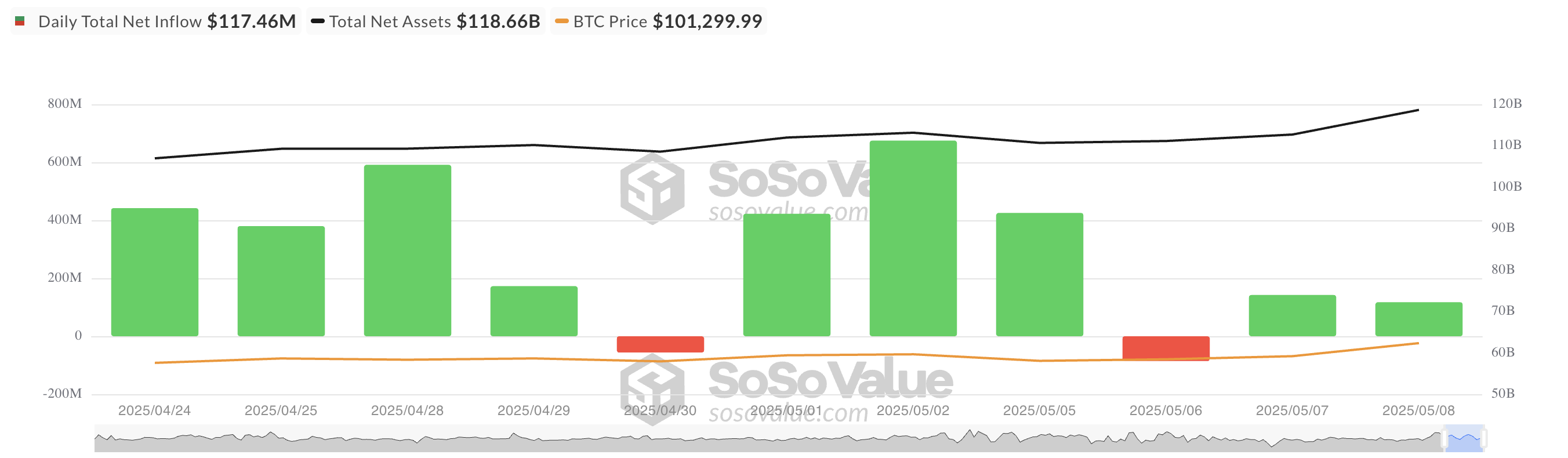

You ready for the numbers? Yesterday, Bitcoin-backed ETFs invited a net flow of $117.46 million—down 17% from the day before. (So what? We’ve all had a little post-party slowdown. Try having a brisket hangover.) Sure, it dipped a smidge, but the money’s still coming in, proving that investors have more faith in Bitcoin than they had in Beanie Babies, and look how that turned out. 🤑

Top banana was BlackRock’s iShares Bitcoin Trust (IBIT). They banked a whopping $69 million for the day, bringing their total net inflow to $44.35 billion. (That’s billion with a B, folks. Or as my agent calls it: “Lunch money.”) Right behind them, we got Fidelity’s FBTC with $35.34 million—totaling $11.67 billion in the piggy bank. Fidelity’s so happy, they’re probably dancing in their suits—and you know they don’t dance.

And here’s the kicker: Of the 12 ETFs, not one—NOT ONE—lost any money. That’s rarer than a polite honk in Brooklyn.

BTC Rally: Six Figures and Everybody’s Losing Their Minds

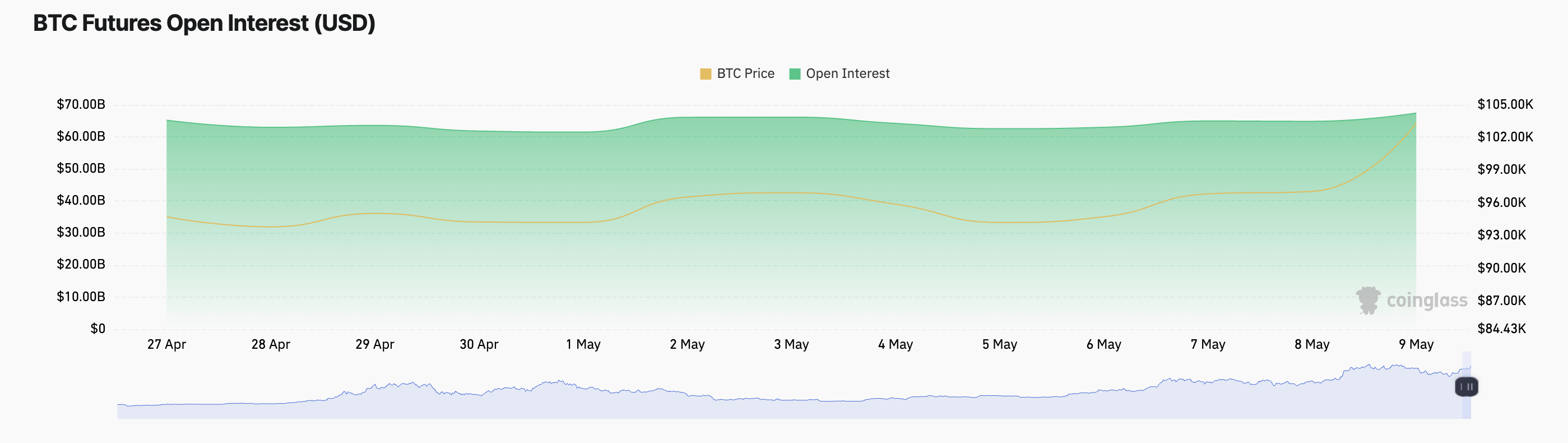

Bitcoin didn’t just peek above $100,000—it put on a sequined jacket, broke down the door, and announced, “Hello, world, I’m back!” This set off a buying frenzy in the futures market that would make even Mel Gibson trade in his last ham sandwich.

BTC futures open interest hit $67.45 billion, up 5% in a day. Translation: The gamblers—er, sophisticated investors—are piling in. When open interest and price both go up, it means new money is joining the party. And when new money joins the party, somebody’s probably going home without their coat. 🎲

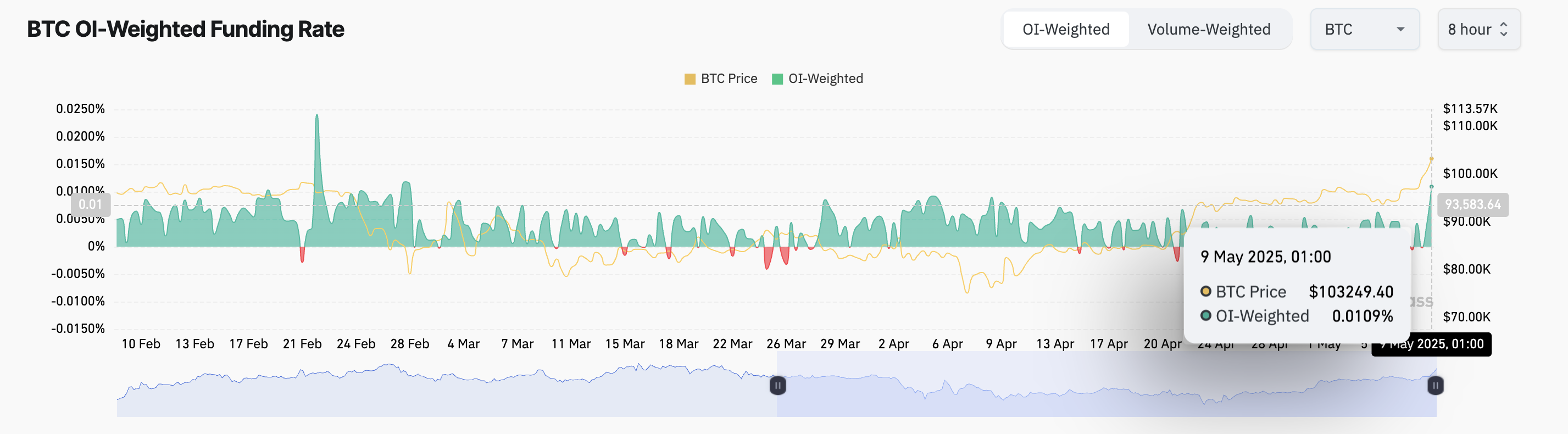

Meanwhile, Bitcoin’s funding rate has taken a rocket to the stratosphere, hitting levels we haven’t seen since February 28th: 0.0109%. Futures traders want in so badly, they’re practically paying a cover charge! At this point, staying long on Bitcoin is starting to look like buying a ticket to “Hamilton”—expensive, and you hope you look smart by the end of it.

The high funding rate shows longs are so optimistic, they’d pay extra just to keep dreaming. How bullish can you get? (Don’t answer that—someone will try.)

But wait—cue dramatic music—the options market isn’t exactly popping champagne. There’s a run on put options, which is Wall Street’s way of waving a tiny white flag—or maybe just a napkin—while whispering, “maybe sell?”

So what’s next? Will Bitcoin soar? Will ETFs throw a parade? Or will everyone suddenly remember they preferred gold and grandma’s chicken soup? Hold on to your yarmulkes, because this market is about as predictable as a family Seder gone long. 🍷

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- EUR CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2025-05-09 11:07