As a long-term Dogecoin investor, I’m finding it disheartening to see the token’s downward trend continuing. The competition from newer meme coins is one factor that’s weighing heavily on DOGE‘s price, and it’s clear that these tokens are seeing more demand from traders right now.

The price of Dogecoin slipped once more on Wednesday, following a gloomy turn in the broader cryptocurrency market.

Doge’s value decreased by over 4% during the early hours of Wednesday, mirroring the trends observed in Bitcoin, Ethereum, and BNB Coin. At present, Dogecoin has plunged approximately 50% from its peak in 2021, and it still falls short by 75% compared to its record high. Below are the reasons why this cryptocurrency has been losing favor among investors:

Competition from other meme coins

The value of Dogecoin has decreased recently due to intensified competition from newer meme cryptocurrencies such as PepeCoin, DogeWifhAt, BonkCoin, and BrentFuckingcoin. These tokens have experienced significant growth, with over 200% increase in value this year, making them standout performers within the crypto market.

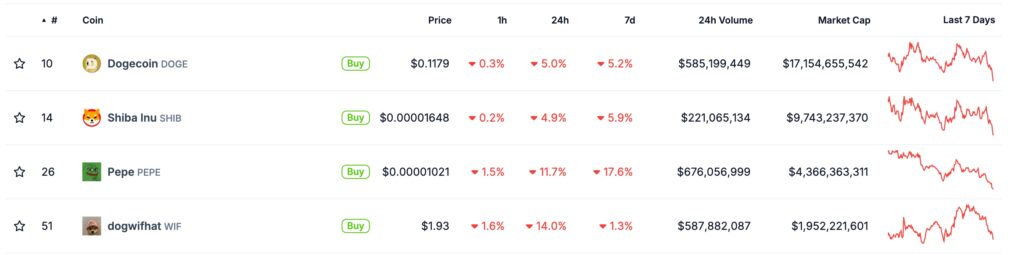

In simple terms, the intensity of this competition is mirrored in the significant trading activity observed daily. According to CoinGecko’s data, Dogecoin had a trading volume of approximately $585 million within the last 24 hours, while its market capitalization surpassed $17 billion.

As a researcher examining the cryptocurrency market, I’ve noticed some intriguing trends. For instance, Pepe, with a market capitalization of 4.36 billion dollars, exhibited a trading volume of 676 million in the recent past. Likewise, Dogwifhat displayed a robust 24-hour trading volume of 587 million. This heightened trading activity signifies growing interest from traders in these newer tokens.

Dogecoin volume vs Pepe and Dogwifhat

Crypto fear and greed index has slipped

Another explanation for the recent withdrawal of interest in Dogecoin and other cryptocurrencies is the growing sense of apprehension among investors.

The closely monitored fear and greed indicator has dipped to the midpoint of 48, decreasing from its highest point of 90.35 this year. Should this pattern persist, there’s a strong probability it will shift towards the fear territory.

In the majority of situations, both cryptocurrencies and stocks tend to pull back when markets exhibit apprehension. This trepidation arises due to the absence of significant trigger events within the crypto sector.

Dogecoin price death cross nears

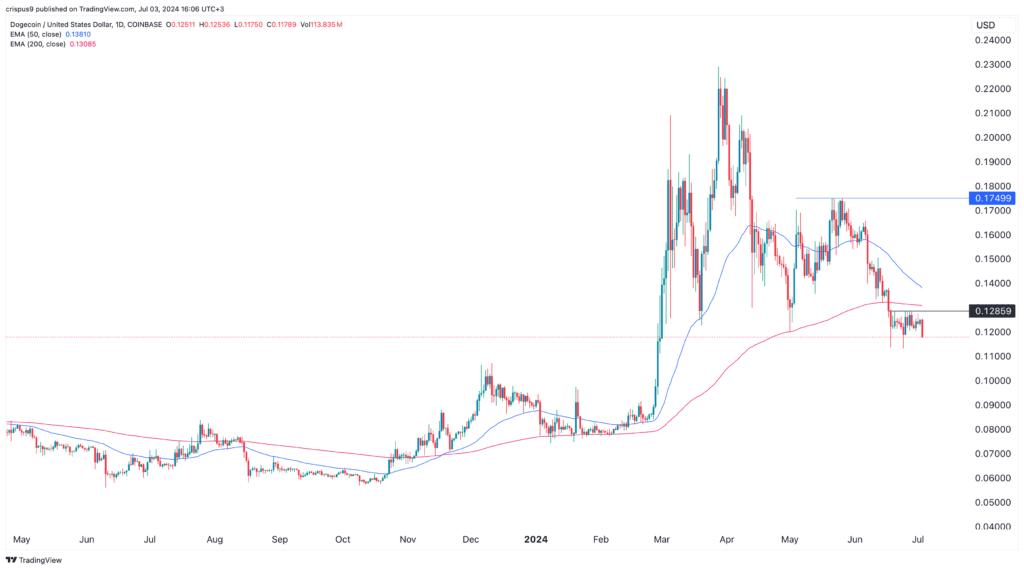

Dogecoin price chart

As an analyst, I’ve noticed that the DOGE price is pulling back due to concerning technical patterns emerging. Specifically, there’s a potential formation of a death cross pattern on the horizon. This occurs when the 200-day moving average and the 50-day moving average intersect. If this event unfolds, it’s often an ominous sign for the coin as it indicates an intensified selling pressure.

As a crypto investor, I’ve noticed that Dogecoin’s previous attempts to bounce back have met significant obstacles. For instance, in May, it encountered a formidable resistance level at $0.1750, and the same pattern repeated itself in June, where $0.1285 served as a strong resistance. These bearish trends aren’t unique to Dogecoin; they’ve also emerged in Bitcoin, which significantly influences altcoins. Recently, Bitcoin has displayed a quadruple top formation and dipped below its 100-day and 50-day moving averages.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-03 16:20