As an analyst with a background in economics and a keen interest in cryptocurrencies, I find the U.S.’s history of handling Bitcoin quite intriguing. The fact that the U.S. government holds a significant amount of Bitcoin – over 1% of the total supply – is noteworthy. However, it’s essential to remember that context matters when evaluating this situation.

The United States has a lengthy past of inadvertently disposing of Bitcoins at unfavorable moments, potentially missing out on amassing vast fortunes.

It’s surprising to consider that, up until quite recently, the US government held more Bitcoins than MicroStrategy did.

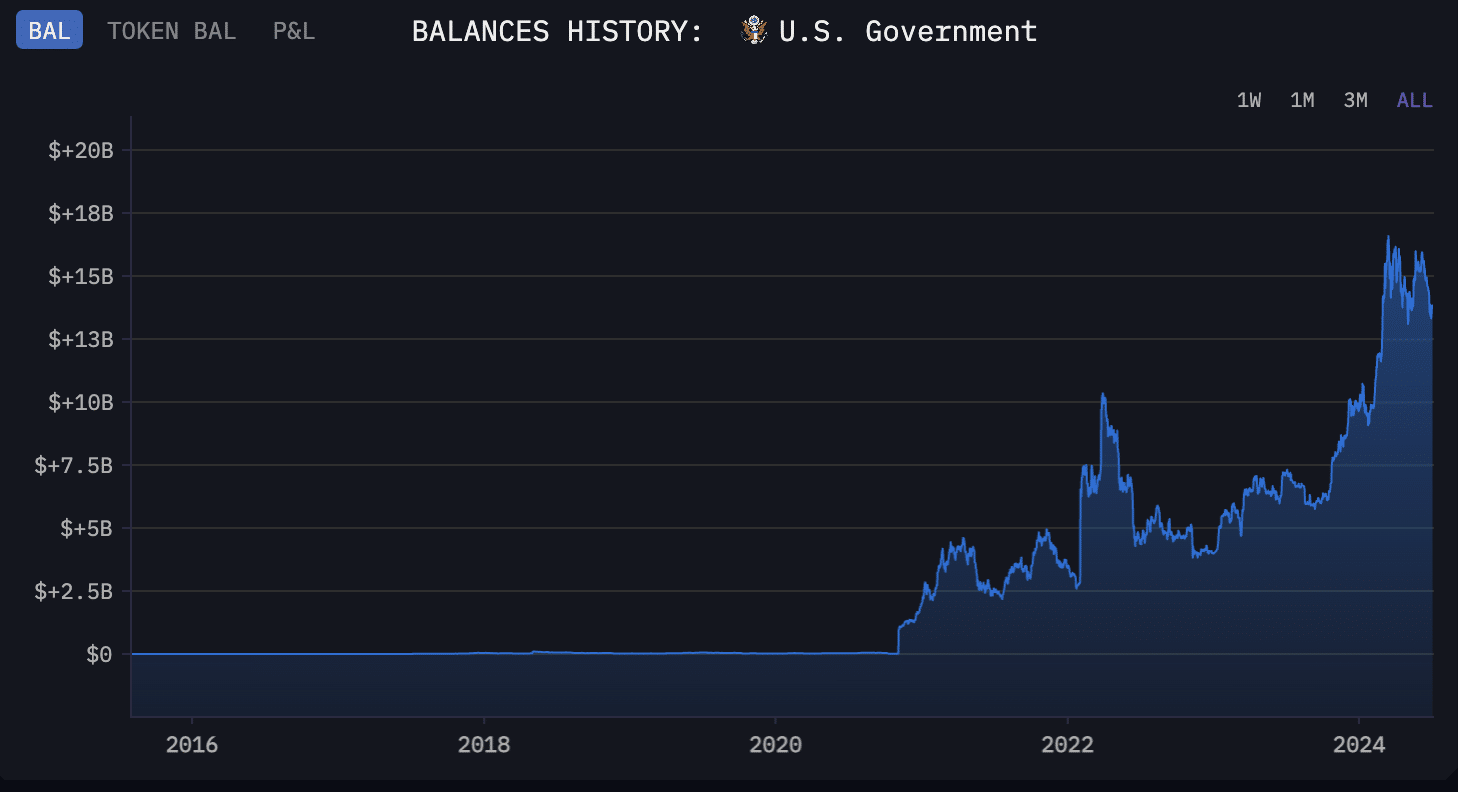

As a crypto investor, I’ve come across intriguing news from Arkham Intelligence. They report that recent criminal crackdowns have led to a significant seizure of 213,543 Bitcoin by the US authorities. This stash represents over 1% of the entire Bitcoin supply, making Uncle Sam a substantial holder in the market.

MicroStrategy became the first company to significantly increase its holdings of Bitcoin on its balance sheet as early as August 2020. However, it wasn’t until March that they exceeded the threshold set by this milestone.

If we consider these numbers separately, it might seem that America’s large Bitcoin holdings indicate strong optimism towards cryptocurrencies, signaling faith in the digital currency market.

But make no mistake, the U.S. is no El Salvador.

As a crypto investor, I’ve noticed the concerns raised by American politicians, regulators, and law enforcement agencies regarding Bitcoin’s impact on the US dollar. They argue that this decentralized digital currency could potentially weaken the position of the greenback in global finance. Furthermore, they have voiced their worries about the possibility of Bitcoin being used for illicit activities such as money laundering and criminal transactions.

As a crypto investor looking back at my portfolio, I can’t help but be influenced by the significant portion of my holdings that originated from two pivotal seizures. Late last year, around November 2022, I became the fortunate (yet unwitting) recipient of 50,676 BTC that were previously concealed in a private residence. These digital assets had been unlawfully obtained by an individual who infamously misused the Silk Road darknet marketplace.

As a researcher delving into the peculiar circumstances surrounding James Zhong’s seized coins, I uncovered an astonishing detail: some of these coins were hidden on a solitary microcomputer, nestled within a popcorn tin submerged under blankets in a bathroom closet.

OK… that’s quite an unusual hiding place.

As an analyst, I’d rephrase it as follows: In the same year, my analysis uncovers a significant event where approximately 94,000 BTC, which had been stolen from Bitfinex, were recovered by a married team before they were later accused of money laundering.

All of this opens the door to another question: what should the U.S. do with all this crypto?

HODL or auction?

Some American politicians have advocated strongly for the government to keep holding onto its cryptocurrency, believing that doing so could result in greater value gains over time.

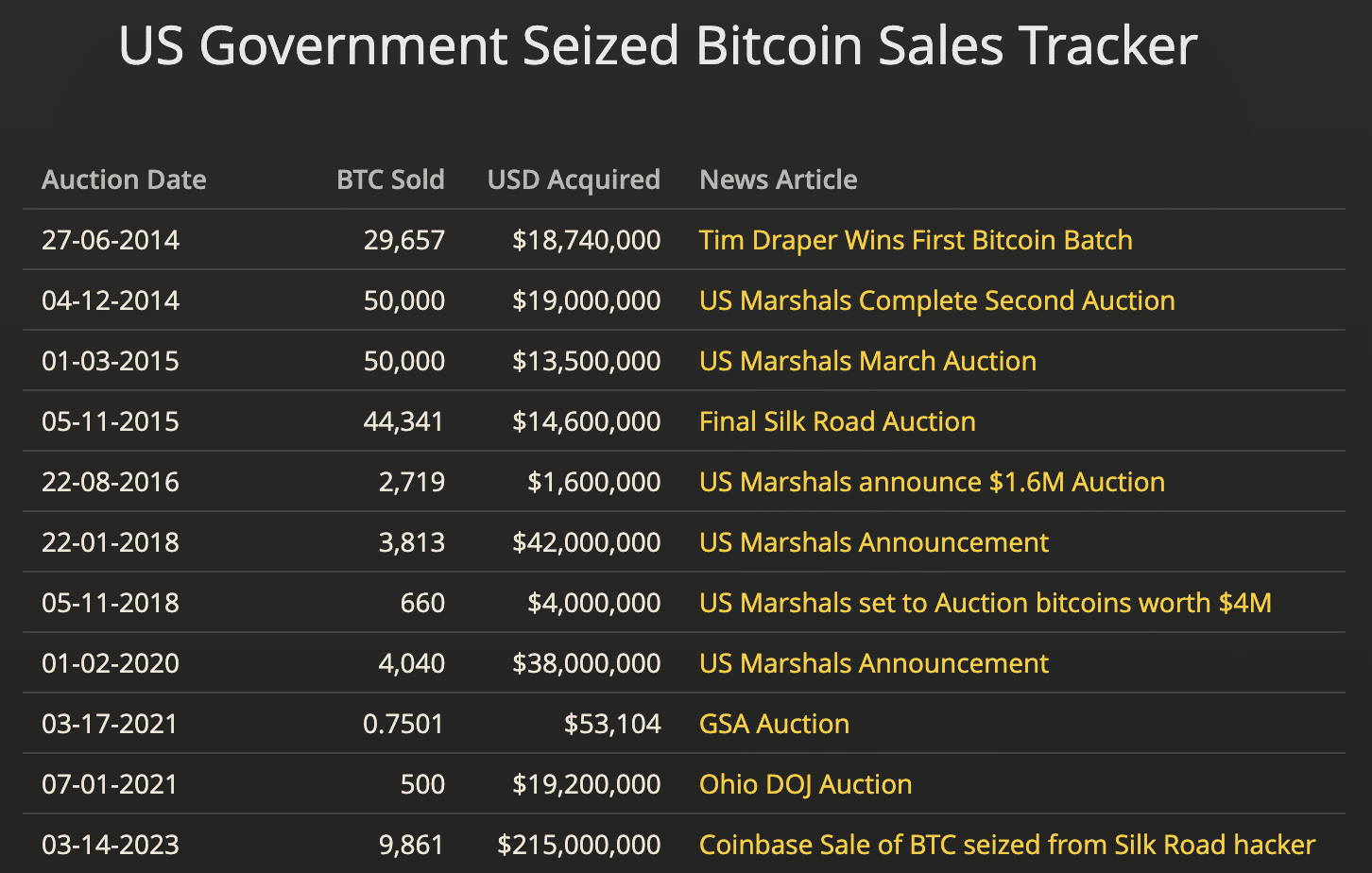

However, the United States began disposing of Bitcoins as early as 2014, yet evidence suggests that this process hasn’t proved particularly effective for them. For instance, according to Jameson Lopp’s research on historical sell-offs:

As a crypto investor, I’ve calculated that the government has pocketed approximately $366 million through past sales. However, considering the significant price increases in recent years, there’s a possibility that they may have overlooked potential gains of around $11.7 billion.

In the year 2014, approximately 50,000 BTC owned by Ross Ulbricht were disposed of for $19 million. Nowadays, that equivalent amount of Bitcoin is worth over $3.1 billion. What a painful loss.

In regular speech, you could say: The US Marshals Service usually manages transactions with the proceeds being distributed among various federal agencies, law enforcement teams involved in apprehending criminals, and victims of the crime. Any remaining funds are returned to the Treasury.

As a crypto investor looking back, I wish I had held on a few more years before selling during those market downturns when American officials were unable to predict the future. It’s now evident that waiting it out could have led to greater profits in the long run for the affected victims.

Unphased by this, the government disposed of an additional 9,861 Bitcoins linked to Silk Road in March 2023, fetching approximately $215.5 million after transaction fees. This equated to an average price of around $21,853 per coin. The administration had intended to auction off nearly 40,000 BTC in four subsequent batches throughout the year. However, significant Bitcoin transactions have been observed recently, yet it appears these deals haven’t been concluded as of now. According to GlobalData Thematic Intelligence:

As a seasoned crypto investor, I’ve observed Bitcoin’s historic performance. If this trend persists, my personal stash of 210,000 Bitcoins would accumulate significant value by 2030. In fact, it could potentially rival the U.S. central bank’s current gold holdings, valued at over $600 billion.

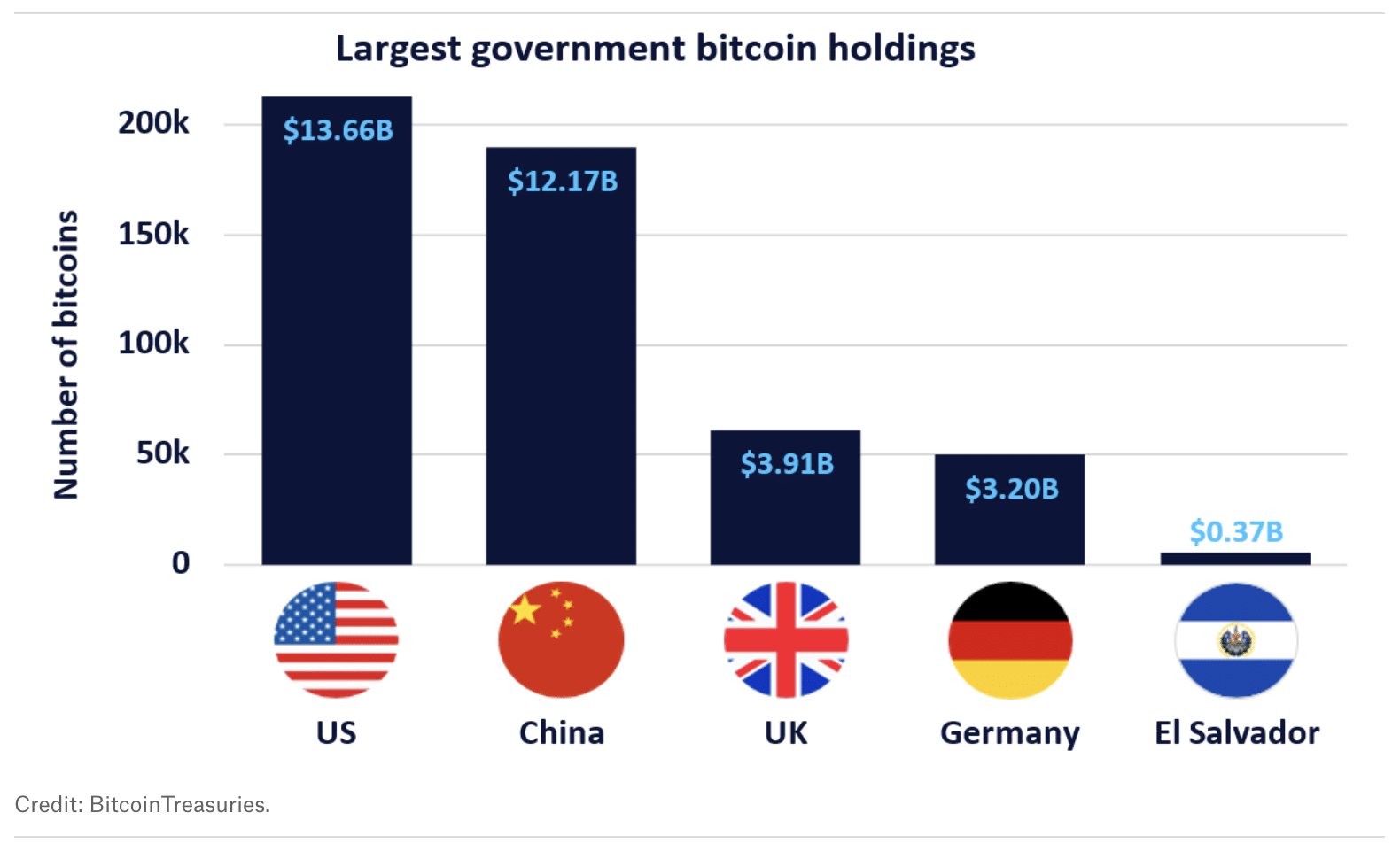

What about other countries?

As a researcher studying the global holdings of Bitcoin (BTC), I’ve discovered that China, the United Kingdom, and Germany collectively own nearly $20 billion worth of this cryptocurrency. Lately, there have been increasing concerns that Berlin might be on the verge of initiating some sell-offs, leading to apprehension within the Bitcoin community.

A significant amount of confiscated Bitcoins from European authorities has been transferred to centralized exchanges.

Occasionally, the burden has significantly affected Bitcoin’s current value due to concerns it could intensify sell-offs and align with the upcoming distribution of compensation from Mt. Gox to its creditors.

Bitcoin’s short-term price could be negatively impacted by those very same entities it was designed to circumvent. Unforeseen regulatory actions or crackdowns from governments around the world could potentially create turmoil in the market.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-03 17:44