As a seasoned crypto investor with over a decade of experience navigating the volatile world of digital assets, I’ve learned to stay calm amidst market turbulence and maintain a long-term perspective. The recent Bitcoin price retreat is not surprising, given the geopolitical tensions and the fear creeping into the market as indicated by the fear and greed index. However, it’s important to remember that every pullback in Bitcoin’s history has been followed by significant gains.

The price of Bitcoin dipped for four straight days, with the cryptocurrency fear and greed indicator returning to the “fear” region, while geopolitical tensions increased.

Bitcoin’s price dropped to $60,200, marking its lowest point since September 18th, and is now 8% lower than its peak from the previous week.

At the moment, there’s a trend where investors are adopting a cautious approach due to heightened geopolitical concerns following Israel’s promise of reprisals in response to Tuesday’s incidents.

These risky investment options such as the Dow Jones, S&P 500, and Nasdaq 100 indices have been experiencing a downward trend in recent times, coinciding with an increase in bond yields. Additionally, the U.S. dollar index has climbed up to $101.50, marking its highest point since September 13.

Bitcoin experienced a pullback as well, with some big investors (whales) continuing to offload their holdings. One of these whales, identified as Ceffu, removed 3,372 coins valued at approximately $211.3 million. It’s worth noting that this account has been actively selling not only Bitcoin but also Ethereum (ETH), Solana (SOL), and Avalanche (AVAX). As reported by Arkham, the total assets held by this entity exceed $2 billion.

After the $BTC price dropped, #Ceffu withdrew 3,372 $BTC($211.33M) from #Binance in just 2 days! — Lookonchain (@lookonchain) October 2, 2024

Another investor sold 265 Bitcoins for $17.5 million last week. He acquired those coins for $6.2 million two years ago, making $11.5 million profit.

Based on Santiment’s analysis, the recent flip in trends can be attributed to heightened excitement about the coin across social media platforms. Typically, Bitcoin experiences a decline when there’s excessive excitement among social media users.

Currently, the Crypto Fear and Greed Index has dipped into the ‘fear’ range, specifically at 39, as compared to the peak of 60 just a week ago.

Positively speaking, Bitcoin tends to perform well during October, boasting an average return of approximately 20.6%. This is followed closely by November, which historically has yielded average gains exceeding 46%.

Possible ways to rephrase:

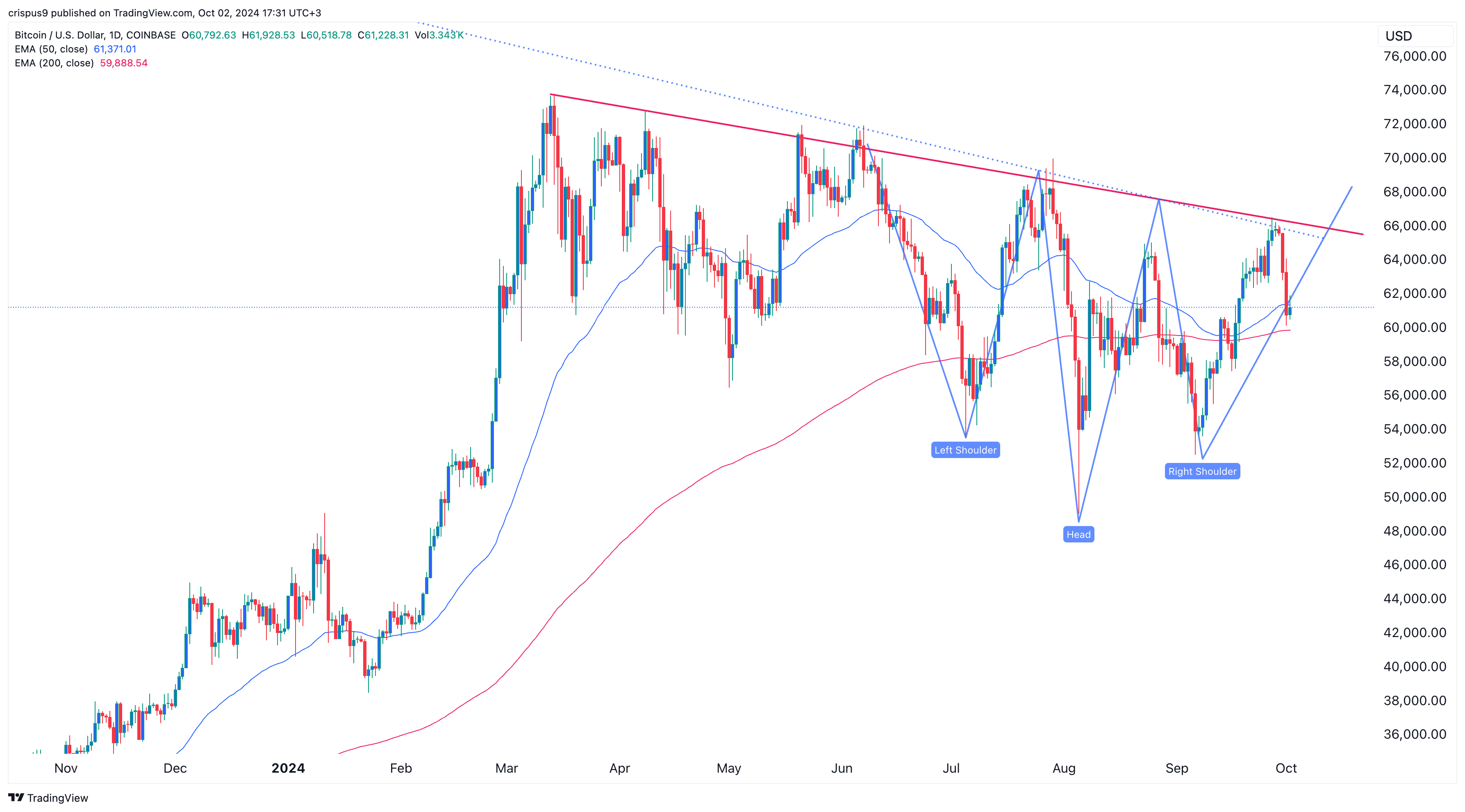

Bitcoin price hit a key resistance

Essentially, after touching the significant level of $66,000, the coin retreated. This price point is noteworthy because it corresponds to some of the highest fluctuations we’ve seen since March this year. In his analysis, renowned trader Peter Brandt stated that a genuine breakout would be confirmed if the coin surpasses the $66,000 resistance and then moves beyond its all-time high.

The latest surge in Bitcoin has not disrupted its seven-month pattern of successively lower peaks and troughs. For us to confirm that the trend originating from the November 2022 low is still ongoing, a close above 71,000 with a new all-time high (ATH) will be required.

— Peter Brandt (@PeterLBrandt) October 2, 2024

As a researcher, I’ve noticed a promising development: The asset has managed to maintain its position above both the 50-day and 200-day moving averages, suggesting stability. Additionally, it appears to have formed an inverse head and shoulders pattern. This technical formation often indicates a potential reversal in trend, leading me to believe that there’s a good chance it will regain momentum in the near future.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-02 18:01