As an experienced crypto analyst, I have witnessed firsthand the rollercoaster ride of the past few days in the cryptocurrency market. The recent dips have extracted over $280 billion in liquidity from the market, with Bitcoin and major altcoins experiencing significant drops below 40%.

Over the past few days, the crypto market has experienced significant downturns, resulting in a loss of approximately $280 billion in liquidity. These steep declines in Bitcoin‘s value have caused major altcoins to drop even further, with many now trading more than 40% below their previous prices.

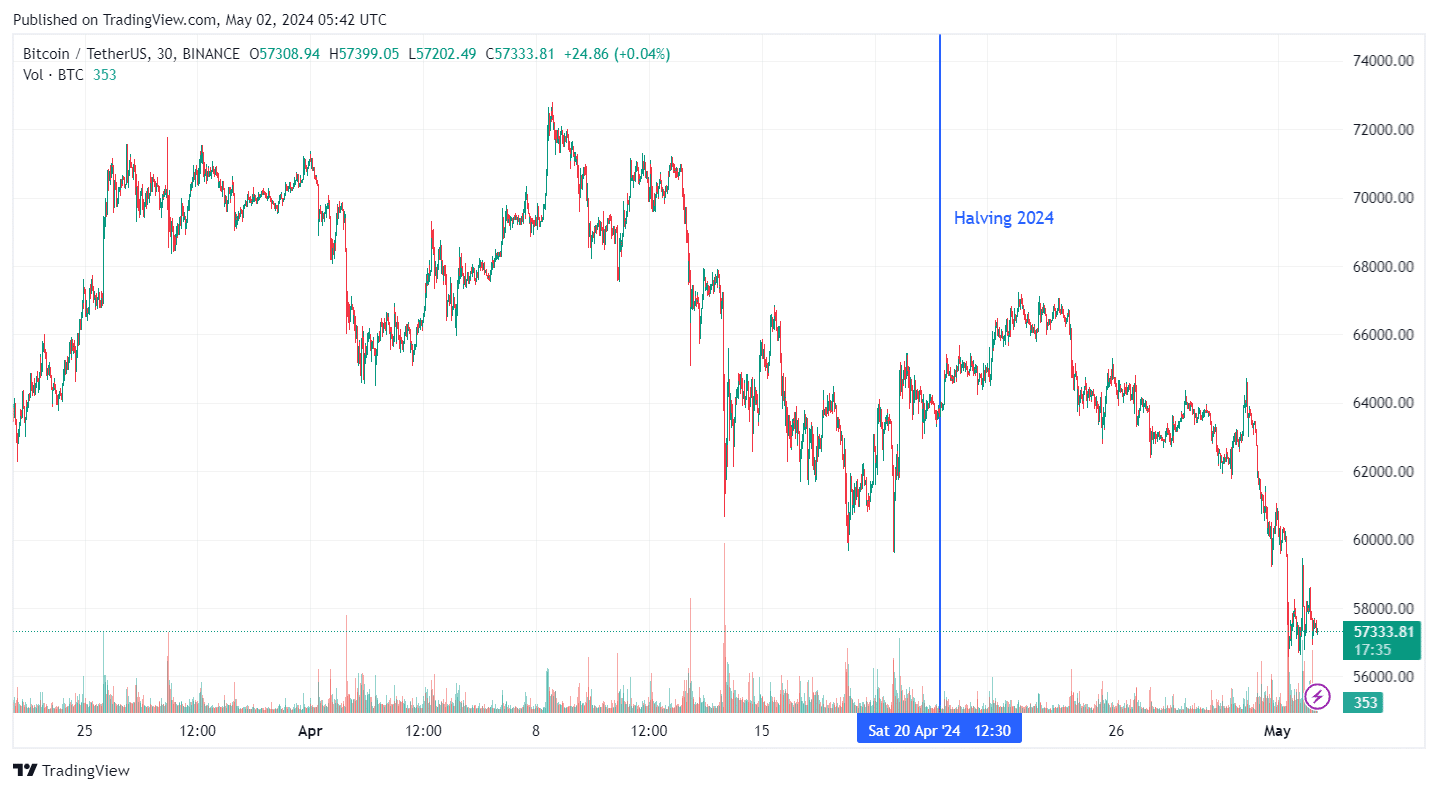

Over the past few days, I’ve noticed significant price fluctuations in Bitcoin. This volatility can be attributed to various factors: the approaching halving event, the possible consequences of a Bitcoin ETF approval, and the US government’s rate hikes. Throughout March and April, the balance between positive and negative sentiments kept Bitcoin hovering around the $60,000 mark.

Despite the bullish market trend prior to the Bitcoin halving event, there’s been a shift in sentiment recently. In just a few days, the Bitcoin price has plummeted from its peak of $67,200 to $56,500 – translating to a 15% decline. Though this drop is expected due to market volatility, it comes as an unwelcome surprise amidst the ongoing bull run.

Why Bitcoin Is Going Down After Halving

As an analyst, I’ve noticed that one factor contributing to the recent decrease in Bitcoin’s price is the absence of significant news events. Previously, positive news such as the anticipation of on-the-spot ETF approval had driven Bitcoin’s price up from $40,000 to $70,000. Similar trends have also supported Bitcoin or kept it afloat at a certain level. However, recent highly publicized launches of spot ETH and BTC ETFs in Hong Kong have failed to make a substantial impact, with first-day trading volumes amounting to only $11 million instead of the anticipated $120 million.

As an analyst, I’ve noticed that with no significant upcoming events, Bitcoin has been struggling to maintain higher price levels recently. Additionally, the fact that Bitcoin failed to break its all-time high before the halving event was a departure from the past three halvings, where Bitcoin typically surpassed previous highs in the post-halving phase.

As a crypto investor, I’ve noticed that Bitcoin’s dominance has been decreasing since it reached three-year highs in early April, following a dip in its price. This ratio, which represents the percentage of the total cryptocurrency market capitalization that Bitcoin holds, dropped from 57% to 54% within a few days. With the ongoing altcoin season, I anticipate this ratio to continue shrinking and potentially fall below the 50% mark in the upcoming month.

This unexpected development has left markets pondering potential sideways trends following the breach of record-high levels.

Could Ethereum Outperform Bitcoin in Coming Months?

Among cryptocurrency experts, it’s widely believed that Ethereum has more room for explosive growth compared to Bitcoin. Although Bitcoin has surpassed its previous record-breaking price point in this market cycle, Ethereum is yet to gather enough momentum to reach a new peak.

As a crypto investor, I’ve noticed that the highest price Ethereum (ETH) has ever reached was $4891 based on market data from Coinmarketcap. Earlier in March, ETH came close to this record at around $4066. However, surprising enough, it didn’t come close to reaching its previous high despite Bitcoin (BTC) typically setting the stage for new all-time highs for altcoins like Ethereum.

As a crypto investor, I’ve noticed that the market turbulence has caused ETH to dip below the $3000 mark recently, losing its previous strong support. However, optimistic forecasts suggest that ETH’s price surge in the coming months could even surpass that of Bitcoin. This prediction is backed up by a few key factors.

ETHBTC Recovery

The Ethereum-Bitcoin (ETHBTC) exchange rate has reached a 3-year low of 0.048, with no clear support in sight at the current level, as indicated by the chart. Some market analysts believe that this is the lowest point for ETHBTC and it’s now reverted to the levels last seen during the early stages of Bitcoin spot ETF investments. A potential turnaround for ETHBTC could push the pair up to 0.08, prior to Bitcoin regaining its $70,000 price peak.

Should Ethereum (ETH) surmount new heights post its Spot Exchange-Traded Fund (ETF) approval, the value increase may pave the way for unprecedented growth. It might reach new peaks far beyond Bitcoin (BTC), leaving it significantly in the dust.

Potential Approval of ETH ETFs

The anticipation surrounding the potential approval of an ETH ETF remains palpable, despite the SEC’s decision being postponed until May 24th. While many market participants predict a rejection, an unexpected outcome could significantly impact ETH’s price, potentially reaching $4000 or even surpassing it. Notably, Hong Kong had already approved the first ETH ETF before the USA, but its reception was cooler than anticipated.

Should Ethereum (ETH) receive approval, it has the capability to attract substantial investments due to its significant growth potential. With Ethereum being more technologically sophisticated than Bitcoin yet holding a market dominance of only around 17%, this could result in a sizable influx into the market.

Deflationary ETH Supply

As an analyst, I’ve observed that the highly anticipated Ethereum Merge upgrade has significantly altered the nature of ETH from an inflationary to a deflationary asset. Following the implementation of this upgrade, approximately 432,000 ETH have been burned, as indicated by data from Ultra Sound Money. This mechanism allows for a positive burn-to-issuance ratio, which eventually contributes to a reduction in the overall Ethereum market supply over time. With this decreasing supply and increasing demand, the long-term benefits for the Ethereum market are promising.

As a researcher studying the cryptocurrency market, I believe the coming months hold great importance for Bitcoin’s future and mark the beginning of the post-halving period for price accumulation. Some prominent analysts anticipate that Bitcoin’s price growth may decelerate during this market recovery phase. In contrast, Ethereum and other leading altcoins could potentially hit new all-time highs.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-05-04 15:17